The only constant in life is change itself. This is also certainly true as it applies to my collecting journey so far.

When I started to collect watches over a decade ago, the world was very different than today. Watches as a collectable asset was still in its infancy (pretty much non-existent), Instagram was not yet being widely adopted, and information available was still rather limited. Fast forward to today and almost everything has changed. Social Media has exploded in importance for watch collecting, smart watches have become the best-selling watch category, and within mechanical watches new brands have emerged. On top of all this, a new generation of collectors have set the tone on what watches are collectable.

Allow me to take you on journey, how I started collecting, what has changed in the past 10 years, also in terms of my thinking and my own watch collecting. In Part 2 I want to highlight what could affect the watch collecting industry in the future, how the industry is changing (in terms of auction houses and new groups emerging) and finally how my own collecting will change.

My vintage watch collecting journey started in October 2012 when I bought a Rolex 5512 with chapter ring and glossy dial. Most importantly it had pointed crown guards.

I remember it took quite some effort on my part to understand all the details of Rolex collecting. I looked at 10 different types of crown guards (they range from pointy to flat, to square and even eagle beak) to make sure what I was buying was really pointy. Back then pointed crown guards was super important and just ticked one of the boxes in collecting. So was a glossy dial and chapter ring. Those were details and attributes you wanted to have in a rare and cool Rolex sports watch. And it was with Rolex sports watches where I got my education and learned to study the details.

(Details of small crown Rolex submariner 6205 / Credit: DB).

It was a time where Rolex had huge momentum and Rolex sports watches climbing in value rapidly.

My go to reading back then was the well-known Rolex blog: Rolex passion report and it fair to say that I learned a lot from it back then. After the 5512, some small crown Rolex submariner followed, and then a few GMT Masters. Before you knew it, I had a nice small collection of Rolex sports watches. In fact, I was so in love with Rolex that I decided to sell some other watches I had: gone went the Lange Datograph (the original one) and I also sold my Lange Zeitwerk luminous Nr 2 (that I bought directly from Lange themselves in Dresden). I also didn’t care for my FP Journe (Octa reserve). I sold it at a slight loss as the nobody wanted to buy the brand back in 2012.

(Incredible details of a 6204 small crown by Atom Moore).

I was obsessed by Rolex. And nothing was going to get in the way of that. I was not alone. Rolex had unrivalled momentum that not even Patek could keep up with. And the legendary and epic sale the Daytona Lesson one, which took place in May 2013 led by Christies and Aurel Bacs at the time just seemed to be the cherry on the cake.

Vintage Rolex was on fire and seemed unstoppable.

The time of 2012-19 were really the glory years for a vintage watch collector. Not only in terms of finding dream Rolex watches but also Patek or rare Audemars. Some fantastic watches appeared at auctions.

Rolex star dials Ref 6062 (with black dials) came up for auction (not to mention the Bao Dai), So did the Rolex star dial galaxy 6088 (with black dial). The most beautiful gold star dials 6062 came on the market. Within Audemars-not one-but two 5516 perpetual calendars were sold during those years. Complicated Patek? What about the 1518 steel (that the Patek Museum doesn’t even own), yup that sold in 2016 with Phillipswatches and so too did a split seconds Patek Ref 1436 in steel (back in 2015 also by Phillipswatches).

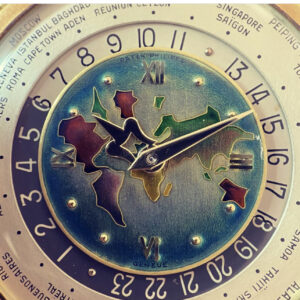

If you wanted the end game in Patek collecting, several double crown Worldtime watches Ref 2523 came up, including this dream pink gold blue Enamel dial – that still holds the world record for any Enamel watch dial sold at CHF 8.7m (see picture below). These watches were the trophies among vintage watch collectors, the holy grails. If you liked Vintage trophy watches it was like being a kid in the candy store.

Everything you dreamt of was available. You just had to have had the necessary capital.

(A double signed Pink Gold Ref 2523 Worldtime Patek Philippe /Credit: Christieswatches)

It was also a time of rapid growth in terms of knowledge the vintage collector gained. Thanks to Hodinkee (especially when Ben Clymer was still writing), A collected man, RPR, VRF, The PuristPro, and more recently Amsterdam Vintage Watches (their videos are fun to watch and are good learning at the same time) and Collectability (who in my view offers among the best educational value in watches with their podcasts and videos). And last but not least let’s not forget Instagram in general which has been an incredible force in allowing collectors to learn about watches.*

Also, the auction houses should be mentioned and commended. Not only are the staff becoming more knowledgeable but their watches they offer better, at least in terms of correctness. Also, the condition reports (CR) improved tremendously. I remember when many auction condition reports read something like this: ‘Watch in fair condition given its age. Although it is ticking at time of inspection given its age a service is recommended’. That was it. I kid you not.

Today you have professional CR that go into detail if the watch has been polished or the dial has been cleaned or is original or service. Even parts like the winding crown and hands are analysed. Transparency has increased tremendously (also among dealers and vintage watch shops); probably also because the collector has become better educated. The improvement in transparency ultimately benefits everyone in the watch industry, especially the collector.

*A shout-out should be made also to the Significant Watches podcast show which is a fun listen in my view and offers another platform to learn about watches and trends.

Another trend I noticed more recently was the rise of the independents.

I attribute their success to several reasons: 1) Phillips watches (which became the leading auction house for watches in recent years) becoming a strong advocate for them 2) the fact that collectors had increasing difficulty in obtaining Rolex and Patek (both vintage and modern). 3) Independents offered a way for collectors to buy into a new generation of case-makers and watchmakers that wanted something different than what the known brands were producing. 4) I think many collectors are attracted to the smaller output of the independents too. Maybe it also had to do with a new generation of collectors entering the market who can relate to a ‘new’ watchmaker. My prediction however, is that many independents will not survive (and I intend to write a blog post about this very topic in the very near future).

(Simplicity in white gold by Philippe Dufour – is my taste admittedly / Picture Credit: Perpetual Horology).

Coinciding with the strength of independents was another trend that a new generation of collectors were pushing: the boom in modern sports watch collecting.

As we move towards a more casual world also in terms of dressing, sports watches seemed a more natural choice than a vintage Patek Calatrava or a Rolex Oyster triple calendar. A new generation of collectors wanted the Royal Oak, the Nautilus and Daytona. This was only exacerbated by the Pandemic. Collectors couldn’t go out and spend money on shopping or restaurants, so they sat at home and bought modern watches. It is unclear whether a new generation of collectors (or simply speculators) were drawn to the market but judging from the growth in registered and online users at the auction houses, I assume the watch collecting world has expanded maybe also lured by the quick economic returns to be made by trading in modern watches.

Watches were being increasingly seen as a way to make quick economic returns. Reels and posts on Instagram like the one below were encouraging new young collectors to buy watches mostly for financial reasons. This only further hyped the explosive growth in modern collectable sports watches, that were already growing due to increased demand for their cult design status, practicality (it does have a function of telling time) but now were increasing seen as a collectable financial object.

(Credit: Manufakturwerk instagram).

While the growth in modern watches boomed, the area that I started with in collecting (vintage watches from the 1940s – 1960s) was slowing down.

Yes, the interest for vintage has remained strong; (albeit not as strong as modern watches) the problem was more one of supply. Collectors who owned great vintage watches saw no reason to sell and those who thought about selling waited for a better time as prices had not increased as much as some modern sports watches. The problem for a collector such as myself is that hardly no good quality was coming to the market (case in point is the 530 Patek black dial below). At the end of 2021 the collecting watch market that I knew, and had started out with, had changed completely. It was almost unrecognizable. Just open a Christies catalog in 2012 and in 2022 – the contrast is astonishing. Or we don’t even have to go back that far. Phillips watches in 2015 versus their latest catalogue.

Auction houses were simply adapting to a different type of demand, and it wasn’t only vintage.

Fast forward to middle of 2022 and the current state of the watch market is most interesting. On one hand you have still enormous interest in modern sports watches (although this seems to be slowing down) but also at the same time you have interest in fine modern watches (e.g Lange & Söhne) and the independents. Demand for vintage also remains elevated.

I think this seemingly bizarre trend of everything flourishing together has to do with the fact that the watch industry has grown over the past 10 years to become a legitimate asset class today. It has expanded by leaps and bounds attracting new collectors who are genuinely interested in it from a horological perspective but also the speculator / investor who doesn’t mind that the economic returns in watches are slowly starting to prove themselves. With so much capital available all watches have profited. Finely made watches (think Lange and Vacheron), independents, modern sports watches, but also anything extra-ordinary in vintage (think Enamel dials, interesting case designs, complications like perpetuals, split seconds, worldtime etc).

A rising tide was lifting all boats. This however won’t last forever (more on this topic in Part 2).

(Watches with fancy lugs will be increasingly sought after as the market matures / Credit: Christies watches).

But-there is another factor that has contributed to the relatively rational state of watch collecting today.

I mentioned it already before but it’s worth repeating again: It is the tremendous amount of information available to the collector that simply didn’t exist 10 years ago. We have made incredible progress in terms of research and scholarship of watches which leads to collectors acting with better information. Think of all the books that came out in the last 10 years. From the Patek Philippe book by Foulkes, to the 175 Patek Christies book, to the great collector books by Fratini and Ali Nael that showed collectors what is out there and that great collections could still be built. Furthermore today a collector can listen to a podcast, watch a video, or read one of the blogs – all this different form of learning was simply not available 10 years ago.

Unfortunately, this also means that the days where a collector can buy a watch that is interesting and important for a fair price is becoming increasingly more difficult. Today if a watch is important, rare or interesting collectors will act. I noticed it like never before this auction season with not only a pocket watch I wanted to buy 605 HU (where I was the underbidder) but also with a rare Rolex watch with Enamel dial that only a connaisseur would bid up (again here I placed the underbid).

This auction season, pretty much any watch that had a complication and was important was bid up fiercely.

(Collectors are increasingly attracted to Enamel dials – as watches become objects of art / Credit: Sothebys watches).

There has been another big change over the past 10 years in watches.

Watches today can sell for the price of a house, a trophy vintage car or important piece of art. This was not the case 10 years ago, where it was rare for Rolex to break $1m at auction. Today every auction season has several Rolex watches that can break $1m, it has become a thing of almost normality. Since 2012 I estimate at least 35 or more Rolex watches have sold more than $1m in the public markets (not including private sales as I don’t have access to that data). Patek selling for $3-5m is not that rare anymore. My point is the financial stakes have risen tremendously in the world of vintage watches.

Perhaps related to the financial aspect, I feel that watches have become Art in many respects (hence collectors referring to watches as industrial art). In my opinion this is also why pocket watches have made a huge comeback and will increasingly be interesting going forward (for reasons I will elaborate in Part 2). This explains why the Worldtime 605 HU and HU DE (DE = Decors Email or Enamel dial versions) in my view has been the comeback watch of 2022 so far. Just in May Christies set a new world record for a Worldtime HU with with Enamel dial (USD 2m). Collectors view it as art (especially the Enamel versions), but also a complication (Worldtime function).

Is it merely a coincidence that Pocketwatches are making a comeback? No. I think it is related to watches being viewed as pieces of art.

(Patek Worldtime 605 HU DE with Enamel dial of world map – 1/3 known).

This leads me to directly into my collecting and how it is changed.

It is in hindsight so obvious that my taste would change with time. Today I look at watches (Bubblebacks and pocket watches for example) that I wouldn’t have looked it even two years ago. This is two reasons: 1) taste changes as you get older – it is an uncontrollable force that just takes over 2) As your knowledge and collections grows so do the demands in terms of gaps you want to fill.

Today for example, I am into watchmaking also as an art, as opposed to just buying a watch to put on my wrist. This influences my collection and as a result I have now two pocket watches from zero before. Also, I am now into fancy cases, Enamel dials and just anything that is rather extra-ordinary. The days of me buying a simple Patek Calatrava or Rolex sports watch are pretty much over. Mostly because I own that already but partially because I want extra-ordinary objects of art now in terms of watch keeping (for example like the Worldtime pocketwatch below).

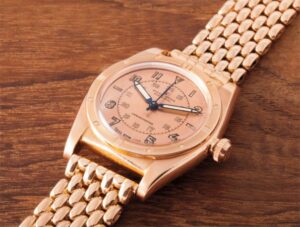

(A rare Worldtime pocketwatch in pink gold by Rolex Ref 4262).

I increasingly view watches as objects of art.

So at this point in time, I am looking for interesting case designs, dial materials and rarity. This together with the fact that my taste has become more refined if causes me to collect differently. A good case in point would be this extra-ordinary pink gold Rolex 1945 bubbleback with two tone dial and Rolex rice of grain bracelet also in pink gold. Back in 2015 (when Phillips Watches sold this at their very first auction ) I didn’t even notice it. Now I would die for something like this. Yes, it is a watch, but it is also an art piece. I think increasingly as the market has matured; more collectors are drawn to watches as pieces of art (this is the reason why vintage Cartier is doing so well in my opinion).

(A circa mid 1940s pink gold Rolex bubbleback with Rolex rice of grain bracelet also in pink gold).

I regrettably admit that there two factors beyond my control that probably have also influenced my collecting.

1) The lack of great available vintage watches. We live in a world where the great watches (for the most part) are sitting in private collections and not coming to the market. This has been going on for quite some time now (I would say at least 3 years). This means that when something does come to the market that is interesting – there is only one thing that counts: Financial power. As the knowledge becomes better among collectors the only differentiator in the end is financial power to purchase. There is a saying that money cannot buy you taste, but as collectors get more educated and recognise taste, financial buying power is really the only differentiator in the end.

2) Instead of having more assets to spend on watches with time, the opposite has happened to me. So much money has been made by other and especially new watch collectors that my purchasing power seems to have decreased on a relative basis- and this obviously affects my ability to collect what I want. Simply put: I am increasingly getting priced out of the market. I am being outbid by other collectors. This has only gotten worse in the past 12 months.

However, I believe this might be reversing in the coming year (more on that in part 2).

(Vacheron Triple Calendar Ref 4241 pink gold with two-tone dial).

My closing thoughts are the following: Ten years in a bigger picture if things is really not a long time; but yet it seems like an eternity in terms of watch collecting and how things have changed.

When I started vintage Rolex sports watches was the thing to collect. Now, nobody shows them anymore. In 2011 I walked into a Tiffany in NY and bought a Nautilus Patek double signed Tiffany with a discount as I was transferring cash. Today this would be unthinkable. After a almost bubble like growth in sports watches (including Nautilus) that boom is now ending. Pocket watches seemed a dying niche 10 years ago, today more and more collectors are hunting them. Within 10 years, trends have come and they have gone.

As far as my own collecting is concerned, I am astounded by the change in my taste within 10 years. It is so different than when I started out and I attribute that mainly due to owning, experience and knowledge. It has less or almost nothing to do with financial means (with the exception of only very recently – being outbid). The one thing that has remained relatively constant within the past ten years was a piece of advice I would give any collector going forward. Buy what you love. This is the MOST IMPORTANT rule in collecting. This way you don’t have to worry what about any trends.

In this respect I can honestly say I have succeeded as a collector so far and remained true to myself.

NB: In Part 2 I will take a guess where the watch market is heading, how the industry players (not the brands but the auction industry) is changing and what watches I plan to buy in the future.