When the Media starts reporting on classic cars and their strong returns- you can assume that most of the money has already been made.

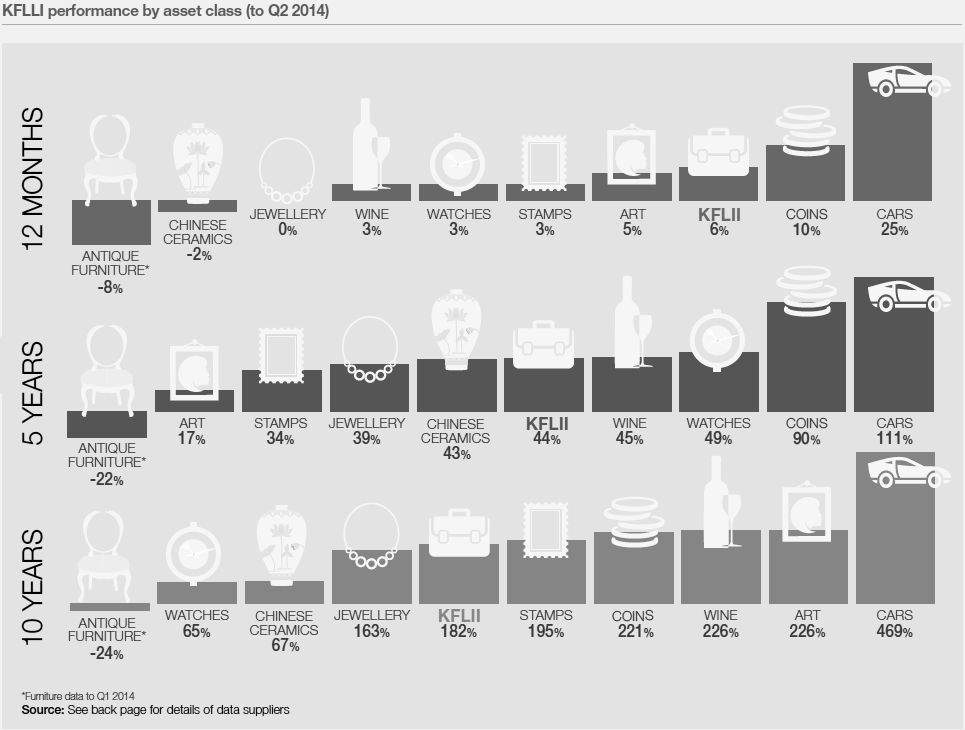

This past Monday the International New York Times had an article on classic cars in which they say that classic cars are increasingly being viewed as a stand-alone asset class. They cited the Knight Frank Luxury Investment Index (see table below) which claims that classic cars have beaten everything from art, watches and coins over the past one year, five years and ten years (see index below).

This is causing some people to wonder if classic cars are indeed a viable investment asset class.

I have nothing against the international press praising classic cars as a viable investment.

But the article is illustrative of an alarming trend I see happening in the collector car world. That the focus of classic cars is not about ‘collecting’ but rather ‘investing’.

The strong returns have attracted many players in the classic car world all seeking financial gain as the primary goal. This is dangerous.

Classic cars should primarily be bought by people who love cars and use them. Of course there is nothing wrong with looking to buy cars that have a strong history of keeping their value or increasing it over time. I personally have done just that. However I am first and foremost a car lover; having bought my cars to use and enjoy them, knowing that down the road they will be probably be a good ‘store of value’ as well.

Most of the money flooding into classic cars presently however are coming from investors rather than collectors looking to park their money in a tangible asset. This is only fine as long as prices keep rising. When prices correct in the future these new ‘investors/collectors’ will be the first ones to head for the exit door.

This brings me back to the article which is the main focus of this post. Investors are attracted to the strong returns of classic cars and the article cites the Knight Frank Luxury Index. The index however has a serious flaw which is correctly pointed out by the author of the article.

It omits transaction costs, storage costs, insurance costs and most of all maintenance costs. As a collector of classic cars I can personally assure you these costs are enormous (especially if the cars have a certain value). So while most readers of this article will be tempted by the returns of classic cars- I think that most of the financial gain in classic cars has already occurred.

In fact I see the market softening going forward (see my classic car outlook for 2015 post here).

My advice: if your not a serious lover of cars don’t be tempted by the returns.

If you looking for simply financial gain there are many other alternative sources to park your money that take up much less storage space, carry no insurance costs and are not expensive to maintain. Diamonds is one example. Wristwatches are another.

(For the complete article of the International New York Times on Monday 15th of December 2014 please click here.)