When I heard that a Texan billionaire heiress Anne Marion’s art collection was up for sale, I was intrigued to learn more.

Who was behind her impeccable taste? What insight and vision did she have in collecting some of the greatest masterpieces of American and International art long before they were known (Richter, Warhol, Lichtenstein). While no doubt she was a visionary and extremely clever in the way she collected, it turns out she was also married to someone who knew his way around the art and collectables world; John Marion. Marion was Chairman of Sotheby’s for 20 years (1975-1994) and auctioned some of the world’s most expensive art, furniture, jewelery and anything else that was collectable at the time. In 1987 he sold the most expensive piece of art, Irises by Van Gogh for a then unheard sum of $87m*. This world record stood for almost three years. He set other numerous world records in the art market in the 1980s, as auctioneer before stepping down in 1994.

In 1988 John Marion wrote a book, ‘The best of everything – an insider’s guide to collecting for every taste and every budget’.

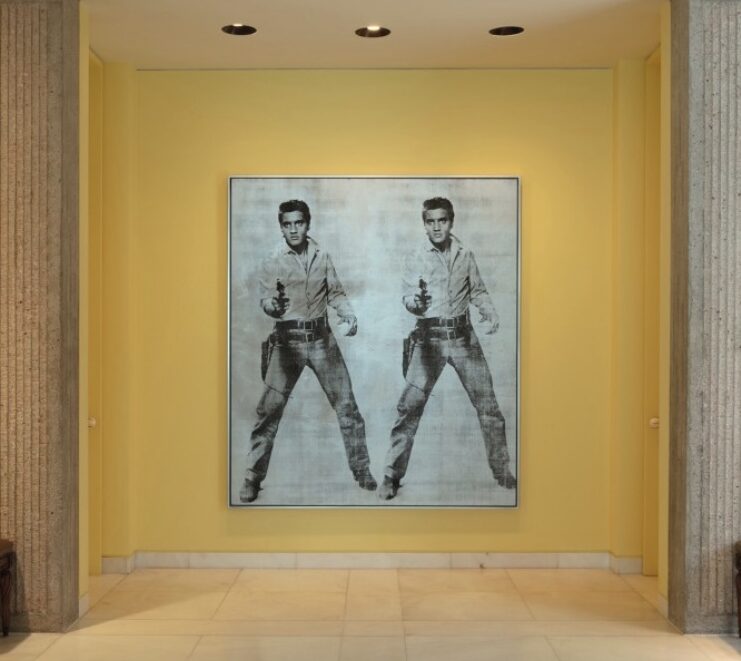

(My favourite artwork from the Anne Marion collection – Elvis Presley by Warhol which sold for just under $40m last month).

Here are the key take-aways from his book (highlighted in black) that might prove useful for any collector. Below I respond to each of his thoughts and how it relates to my collecting journey so far.

- Investing in beautiful things is not only a smart way to allocate assets, but also can be one of life’s great joys. I couldn’t agree more with him. I love looking at and touching beautiful objects be it watches, cars or living with nice art. It is more rewarding than only looking at bank statements. And best of all it has proven to be not a bad asset class over the past decade – which I view as a nice dividend – besides the ownership aspect – which is the best dividend of all.

- It takes time and commitment to acquire an eye for quality. This may sound obvious, but it is so true. I think recognizing quality is something that you have to learn and train for. With time you get better at it, but it is a non-stop learning process. It is why, when I go to auction previews, I even look at watches or objects I have little or no intention of buying but rather want to learn more about.

- A knowledgeable collector will have the upper hand than the ‘fast buck collector’ who is only in it for the money. This is especially true when the collectables market is difficult and prices are not increasing. A collector only motivated by money will be more insecure when times are difficult and sell. If you buy with knowledge and love the object; you will derive pleasure from it even if the financial return is not present.

- The self- educated collector is often in a position to see what others cannot. For me a great point and self-explanatory. The educated collector will probably see the details that a collector only in it for material gain will either overlook, not care about, or even worse, not realize to begin with. This leads directly to the next point that Marion makes below which is super important!

- Collecting is in itself a passionate art. The true collector gets excited not so much by the monetary value but by the intrinsic (meaning he lives with the object and derives pleasure from it). Again, self-explanatory and I couldn’t agree more! I worry that many collectors today in all categories (including watches) are parking their money and regarding it purely as as an asset class. When prices start to fall or correct – they will be the first to exit (which may not be such a bad thing).

- If you want to be a successful collector, you have to be willing to make the emotional investment. Indeed, this goes beyond just buying. It involves research, the hunt for something. Networking. Making friends who can help you (while you help them in return). It means also taking a risk sometimes with the information you have at hand (which often is not really enough). Some of the best purchases I made was with lack of all information I needed. I took a gamble. Yes, mistakes will be made but that goes along with collecting in my view. Mistakes will be made in terms of taste but also financially too. But they will prove to be good learning lessons.

- Rarity is almost always a plus, though strangely enough, it is possible for an object to become too rare. If you own only one of something you need someone else who is interested in the object too. It helps in general to have a strong secondary market. I think he makes a great point here. Rarity is only part of the supply equation. What good does it help if you own a unique object that nobody else is interested in? Take the 5711 Nautilus from Patek. There were more than 25´000 made and the prices trend better than many references whose production is 100th of the Nautilus. Rarity alone is not enough to drive the price of something. You need the demand too.

- The continuing evolution of taste and aesthetics will have an effect on the price of collectables as an area’s importance is established or reassesed over the years. A super important point he makes. Taste changes and impacts collectables as a result. Where 50 years ago square watches and smaller timepieces with complications were deemed more collectable – today a new generation collector is dictating trends. Witness the growth in sports watches. Today a Panda 6263 Rolex exotic dials has often the same value as a 2499 Patek perpetual calendar chronograph (something unthinkable only 15 years ago). Or in cars we witnessed the growth of supercars versus the 1950’s, 60’s cars which have been left behind somewhat. One thing can be guaranteed: Taste is always moving and changing.

- An entire category that may be regarded as aesthetically superior today can be ruthlessly demoted by a change in the prevailing aesthetic theory. Nothing needs be wrong with the item. Only the perception of its value by the collecting community has changed. This can cause major price shifts. It is a follow on from the previous point. Shift in tastes can wipe out an entire collecting category. Witness the decline in antique furniture or valuable carpets. The decline in Pocketwatch collecting. Or even the shift in the art market of old master paintings in favour of modern art (Rothko, Warhol, Lichtenstein, and Koons etc). That is why it is so important to collect what you truly love in my view. Then you care less what is doing well and trendy.

- As a collector you owe it to yourself to apply the highest standards in determining aesthetic quality- as it’s your money your spending so be ruthless. Couldn’t agree more. One of the most important points Marion makes.

- Becoming a successful collector is a never-ending process. Indeed. I am learning still every day and I am sure even most seasoned collector doesn’t stop improving or learning. There is always something or someone out there that you can learn from.

- Today virtually anyone with a few thousand dollars, a passion to collect and a desire to learn can become a connoisseur. I think that this was more true in the 1980’s than it is today – but nonetheless I do agree. My view is that if your passionate and driven – you can become a connoisseur. Because some of the best collectors in the world will allow you to access their knowledge and collection if your passionate. Passion is addictive and can get you very far. And always remember some of the best collectors started from scratch.

- ‘Quality is something you have to see and to feel. When you do – it doesn’t mean everybody sees it and feels it too. Quality is something you can’t describe but you recognize it when it comes along your way’ -William Paley. This quote comes from one of John Marion’s biggest clients and collectors of modern art at the time, Mr. Paley. I think this is only something that experienced collectors are good at. They have touched and felt so many objects that it becomes second nature to them. At a certain point in time a collector will recognize quality almost blindly. I am personally not there yet but I bet a few of my old friends are (Davide, Auro, Simon Kidston etc).

- You can always afford to buy the best of whatever it is you can afford. Yes, yes yes! Such an important rule and also listed as a key collecting rule in the Goldberger interview I did back in 2013.

- Collecting is about seeing something that deeply moves, challenges or on occasion upsets me and knowing that, if I don’t buy it, I am not going to be able to spend enough time with the object to figure out what the experience means to me. Beautifully said. Nothing to add.

- If you want to become a connoisseur, you are going to have to investor time and energy to in the process. You must train your eye to increasing levels of artistic and aesthetic sophistication. Indeed. There is no free lunch. Not in the collecting world either.

- One distinguishing mark of a great collector is his ability to sell his mistakes, to dispose of his earlier lessons if you will. This is very true even if I personally have difficulty selling anything. But this year I disposed of a collectable item that I bought without any emotion (it was purely financial decision). In hindsight it was a mistake and am extremely happy I had the courage to act. Indeed, it is true, a great collector constantly refines his collection as his knowledge increases and taste and financial means change. However, I also think a collector who tends to keep things (like myself), it can prove to be a wise strategy. It forces that collector to think twice before he buys something and adds a level of discipline that perhaps the other type of collector mentioned earlier lacks as his collection is constantly changing. NB: For more on the different types of collectors out there see my post here.

- Objects acquired early in ones collecting career should be routinely reassessed as you refine your tastes. Ideally yes and this goes into the previous point. But aren’t objects collected early on also part of the collecting journey? Let’s not forget John Marion was a salesman at the end of the day. It was in his interest to get collectors to sell things. Having said that he has a good point – many great collectors reassess their collection constantly. Some of the best collectors I know, constantly seek to improve their collection when the opportunity arises.

- Buy for love AND money, but first buy for love. Very simple but very wise words. Maybe the most important collecting rule of all. Buy what you love first and foremost.

*It turns out the most expensive sale ever for a piece of art in 1987 was partially financed by Sotheby’s (with a $27m loan). That world record price of $87 for Irises by Van Gogh would be the start of auction houses partially owning their inventory, what is now known as the ‘art lending market’ by auction houses. And the buyer of Irises? He went bankrupt from being over-leveraged a few years later. His name was Alan Bond, the Australian entrepreneur. He is indeed the man next to the painting. Today Irises belongs to the Getty Museum in Malibu California.

For those interested in ordering the collecting book by Marion, find the details below.