Imagine you go to your local Ferrari dealer and he gives you the brand-new Ferrari GTC Lusso and tells you to bring back the keys in one hour. You drive the thing like crazy, rev if up to 9000 rpm and drift left and right. You arrive back to the Ferrari dealer, your heart still pounding. You then step into your normal car that has 100hp, carries a diesel engine, has four doors and is ideal for a family.

This is the kind of feeling I had in Geneva, after experiencing exhilarating New York. Now Geneva is always fun even if the watches and the mood in the auction room does not get your heart racing.

Geneva has a few big advantages that the New York, HK, or London auctions cannot offer. It is the most global of watch auctions. Dealers and collectors from all the world come to Geneva. I saw many Japanese, HK collectors and Asian collectors (like Taiwan) that did not make it to NY for example. But they come to Geneva to network and attend the most important watch auctions of the year. So, while I did attend all of the most important auctions, I also took that time to talk to dealers, network and meet some collectors (something I don’t really go out of my way to do normally). Here are my observations:

(I will dedicate my Part 2 to Patek only watches, especially the great 96 reference and prices achieved).

- I saw more Japanese collectors / dealers than normal: The Japanese along with the Italians were the first serious watch collectors already back in the 1980s. I think they came out in force in Geneva because of the many Patek being offered and also the themed auction of Calatrava ref 96 by Antiquorum. I think I was the only non-Japanese interested in this sale. Maybe the purity of shape interests them and also the fact that it is a small watch at only 31mm.

- Small watches not in demand: There were many fine Calatrava Ref 96 at Antiquorum that either went unsold or fetched prices that are frankly a joke (large bargains could be found at this sale). Watches at 31mm are simply not in demand today. I spoke with a big dealer who told me has many 130 Pateks on his shelf sitting there unsold for months, as even 33m is considered too small today. The one exception was the split seconds Patek 1436 available at Phillips – that sold for a strong price of CHF 350K hammer – despite it being only 33mm.

- Market recognises quality: It was nice to see the market being more or less rational even for PN. The superb Gold PN 6241 fetched nearly 2x the high estimate for CHF 444’000, while the same model sold at another auction house for less than half that. A complicated pink gold 6062 with explorer dial that should fetch near CHF 1m today, fetched 642’000 – the dial had plenty of marks, spots and the dial with gold indexes rather than pink gold indexes can be questioned and might explain the weak price . The superb 6542 GMT Bakelite fetched CHF 300k – a strong price and if I am not mistaken a new record for a 6542 in steel. The craziest example of market differentiation belongs to this Patek 2585 though. The exact same watch but a sister watch (only two 2585 in steel are known) sold for CHF 785k only two years ago! That is what the price of condition can make! Worth a cool CHF 700k (almost)! Expect a post dedicated to the two 2585 Pateks and difference in quality coming your way shortly!

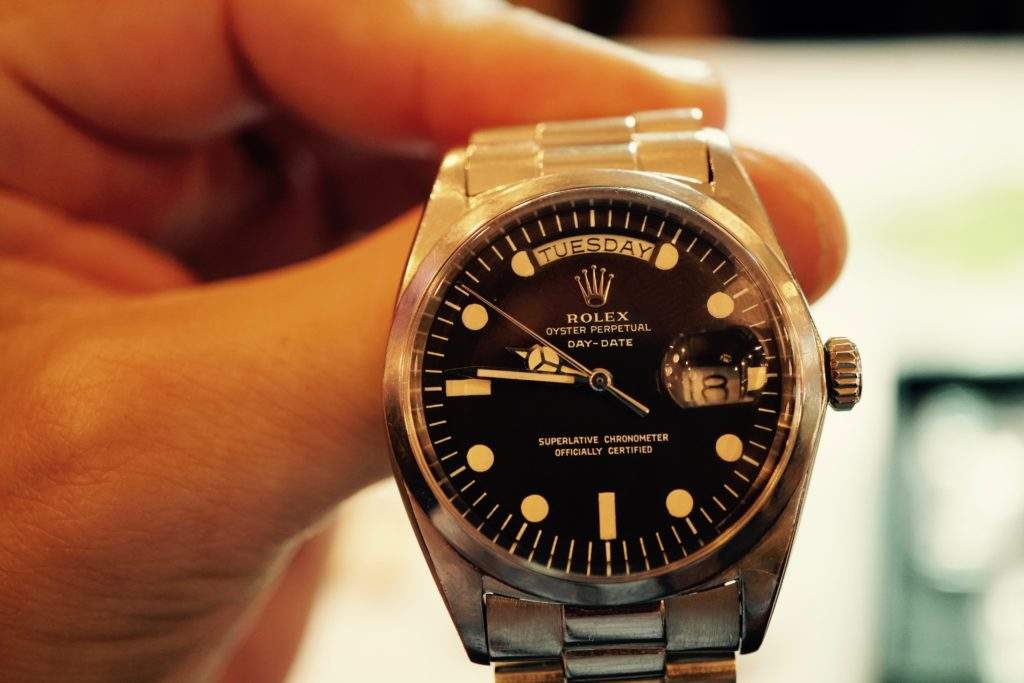

- Market wants unique watches today: If you had something unique and rare the market paid handsomely. An automatic Daytona fetched a whopping CHF 550k a new world record for a Daytona with no 4 digit reference number (made in 1989)! The high price can be explained by the rarely seen blue dial. An unusual Patek with scroll lugs in white gold – experienced a bidding war – selling for CHF 162k – more than 5x low estimate and 3x high estimate. My favourite in terms of uniqueness was a Rolex Day-date ref 1803 with lume and Mercedes hands in white gold. Made for a client (which Rolex normally does not do) in 1969, this watched fetched CHF 275`000, against an estimate of CHF 60-120k. A strong result for sure but think what else you can get for that amount in the Rolex world. A nice pump pusher only PN Daytona that exist by the 100s? The collector who bought this unique day-date knew what he was doing!

- Market values historic watches: With the recent Daytona euphoria, it was nice to see the market valuing historic watches. A new record for an Omega wristwatch ever at CHF 1.4m for the tourbillion chronometer made in the 1940s. An important Rolex explorer 6150 that carried great mountaineering history (but itself was not that attractive) sold for CHF 200’000. I would say the fact that this watch played a part of explorer Rolex history was worth CHF 170’000. Incredible!

- Daytona market very strong: Although it was not a given, but expected in a way -the Daytona market showed strength. It seems the entry level Daytona PN is now CHF 200k for a pump pusher (a few lessor quality sold for CHF 125k) and CHF 400k for a screw down pusher PN ‘Panda’ now. Those are impressive numbers. Gold Daytona was all over the place depending on condition (the star lot was a John Player special that sold for CHF 744k (which I think is a record for that reference and dial layout). The spread between a good gold Daytona and a mediocre one was 2x (meaning a good one sold for 100% + more than a mediocre one).

- Some interesting observations: While Phillips has moved ahead to pole position in high end vintage watches, this time in Geneva the sales were almost identical between Phillips and Christies. I can’t recall when this happened the last time. As with all data if you dig deeper there was a reason why. Christies included the ‘Only sale’ in their watches and you can argue if that should be added in terms of vintage watches or not. Even without ‘Only watches’ Christies had a strong catalogue in my view. In terms of top lots the honour went to Patek clearly this time. That is partially because you did not have any Rolex trophy watches, except for perhaps the Gold John Player Special Daytona. There was no 8171, or 6062 black dial to push Rolex into the $1m dollar stratosphere. So of course, a mint 2499 pink gold (which achieved a record for this reference – despite experts expecting even more for the watch – CHF 3m was expected) and unique 3448 will help Patek secure top lots. In terms of auction houses, I have to mention the superb catalogue of Antiquorum Swiss. I thought their catalogue was very nice and it shows that the new management and split of the previous structure is heading towards the right direction.

Allow me to show some watches which caught my attention and comment when necessary on the prices achieved.

Let me start with a watch that I found fascinating. A 1960s Rolex 6036 Killy in gold (see also main picture). I have been saying this a long time. I think the Killy remains undervalued within Vintage Rolex. In steel but even more so in gold. This watch caught my eye for many reasons. First the case looked so clean and new. Take a look below.

This is because the watch was just polished and received this special texture on the case. The dial, well the dial was not in perfect condition but it was original and honest. Notice the spot at one o’clock hour marker.

Nonetheless the case was strong with three hallmarks noticeable on the reverse side of the case on the lugs. Look at the beautiful movement this watch has. See the Rolex signature on the bridge below.

What is interesting is the case-back of this watch. It was marked 6036 but what I found unusual was the Rolex signature and font on the case back. I have never seen this before. Or maybe I never paid attention.

Overall it was an honest and original gold Killy and brought in only CHF 245’000. I honestly think a gold Killy in this condition should be worth more than that. Much more. You can get a normal (albeit in good condition) pump pusher PN in steel for this price. That should not be the case.

We move onto another nice Rolex watch. A very nice two tone dial pink 6062. The case was fine and the dial carried a beautiful two tone texture seldom seen in 6062 pink gold watches.

The fine two – tone nature becomes even more apparent in the picture below. But notice the dial. It had spots and little nicks and was not of the same condition that we are used to with other pink 6062 that have sold (like this one in 2015 at Phillips). Also the gold indexes rather than pink gold and no lume on the dial had a few collectors confused. This explains why a normally CHF 1m watch sold for only CHF 642’000.

Next, we move on to another pair of watches in gold. A Patek Nautilus 3800 with blue dial and a fine 6263 gold daytona. Both were beautiful watches and I would not mine owning either of them.

For some reason I was having problems with my camera. It was not doing what I wanted. The one watch it seemed to have no problem with was the Panda 6263.

Maybe that is telling me something? Notice the brown outer minute track. This watch sold for a relatively most CHF 408’000 and was the most inexpensive of the Pandas offered at auction (Christies fetched CHF 500k). I think the buyer paid a fair price and it will prove to be a good buy. These Pandas seem to be establishing a price floor now at CHF 400k.

Here another shot of the 6263 Panda which will prove to be a timeless Icon in my opinion. Although this watch was made 40 years ago it is proving just as modern today as back then.

Another Rolex that caught my attention was this 1803 special and unique day date in white gold made as a special order by a client of Rolex.

What made this watch most interesting was the lume and the Mercedes hands on the watch. It fetched a strong CHF 275’000. In my opinion worth every single cent and I think even a higher price would have not been irrational for this unique watch. I especially like how the lume is integrated into the day window at 11 o’clock and 1 o’clock.

Here is how the watch looks on the wrist.

Allow me to move on to something else. I was holding the world of complications in my hands with this Audemars pocket watch.

Called the triple complication, it has a minute repeater, split seconds chronograph and perpetual calendar all in one. It fetched a modest CHF 87k, and if this was a wristwatch we would be talking a figure 6-7x times this amount. Maybe the fact that for nearly 60 years the movement was not cased; only in 1970 was the movement cased, maybe this irritated some collectors. Pocket watches remain undervalued today.

Let us take a closer look at the moon phase. A piece of art in itself the vivid blue and gold stars.

Attending Geneva auctions is also interesting opportunity to look at collectors watches. Because there were some incredible examples.

Like this superb Universal made in the 1940s. Apparently only 6 of these watches with special dials were made. Property of an Italian collector who is less than half my age (and mostly likely will be the next Goldberger of his generation).

Another beautiful watch was this Longines chronograph also made in the 1940s belonging to a US based collector.

Another nice collector brought along a very rare double reference small crown 6536/38. It was in very nice condition from what I could judge. See for yourself below.

My favourite collector watch has to be this incredible 2508 Rolex with olive pushers, sector dial and Beyer signature. The dial was flawless and super strong gilt.

If you look below you see how strong the gilt dial was with black background. 2508 with black dials in this condition are impossibly rare and this is a trophy Rolex watch. Property of an Asian collector whose taste is superb and standards for quality unmatched.

Btw do you guys like my shirt? My mother told me to go out there and buy colors and this is the result. I got a lot of compliments on it so I think I am on the right path.

In part 2 I am going to dedicate myself to the many Patek watches I saw including a great travel time, the superb white gold 2497 and many 96.