‘Overpay’ for trophy assets!

I believe there is a ‘golden rule’ to collecting watches, classic cars or anything of personal relevance and value for that matter: It is a rule which I try and stick to at all times.

You can never pay enough for ‘trophy assets‘.

You see in collecting- it sometimes pays to ‘overpay‘. We will explain in detail shortly what we mean by that.

For now lets get to the point of this post. Picasso’s ‘La Reve’ (the dream) sold for $155m which is a record for a piece of US artwork sold. The owner Steve Wynn, a big art collector and billionaire owner of Wynn resorts- sold it to another billionaire -Mr Cohen owner of SAC Capital the alternative investment specialist.

Now this deal is interesting for several reasons:

1) For one it is among the largest art deals ever to take place. The only known transaction which is larger is the Cezanne deal -sold to the Qatari Royal Family which was valued at an apparent $250m (although nobody can confirm this). 2) The deal is furthermore interesting because Mr. Wynn who suffers from partial blindness in one eye accidentally put his elbow through this painting and severely damaged it in 2006. Experts took several years to restore the painting but nonetheless- the painting is not entirely original anymore.

So why are we pointing this out?

Because, although this painting was damaged- Wynn still managed to sell it for more than 3x what he bought it in 1997 – where he paid $47m. At the time people thought he overpaid by a large margin. The point is: If you are buying the best of something that is available at the time- you cannot make a mistake by bidding aggressively and setting a probable record for it at the time. The best of something by definition is scarce, and thus a premium is often warranted. There is always someone richer and more impatient down the road who will pay even more to acquire the asset. What seems like ‘overpaying’ at the time is often a very good deal. I have done this numerous times with watches but also cars.

Concluding thoughts

The reason this deal is interesting is not for the large amount paid but rather the logic behind this transaction. The deal is very telling how two billionaires go about collecting.

It sounds irrational to pay aggressively for something and even ‘overpay’ in order to acquire the asset at the time. But I have seen it time and time again: It is mostly never a mistake to pay handsomely if your bidding for the best of something. This is not intuitive nor does it apply to other areas such as investments. In fact overpaying for financial assets is often a costly mistake.

Not so in classic cars or watches.

If the best of something becomes available- bid for it in confidence. You can almost never pay too much.

Le Coultre-Deep sea alarm: An Icon goes on the block

In two weeks vintage watch Auctioneer Antiquorum will hold its annual auction in NYC, April 10th, 2013. With over 404 Lots being offered there is just about a watch for every collector.

However one watch in particular deserves our comment. It is Lot 320- a Le Coultre Deep Sea Alarm from 1960.

Before you ask what brand Le Coultre was, it essentially is Jaeger Le Coultre, but in the US market- the brand was sold under the simple name ‘Le Coultre’.

In Europe the same watch was sold under the Jaeger Le Coultre brand and did not carry the name ‘deep sea alarm’ on the dial. We think the US edition-which you see above is much more charming.

Why is this watch interesting?

Well firstly the Deep Sea Alarm was among the first watches that can be called a diving watch, a category that was launched in the end 1950′s with essentially three brands, Rolex with the Submariner, Blancpain with fifthy Fathoms and Jaeger Le Coultre with the Deep Sea Alarm. This watch has further appeal since relatively few pieces were ever produced (estimates are under 1000).

Perhaps what makes the watch most interesting is that it comes from the property of the original family.

Watches that are the property of the original family tend to be in a more original state than when the watch continuously passes on to dealers and various owners (provided the original owners took care of the watch and didn’t accept replacement dials). Lot 320 is an important lot and it is no exaggeration to state that the Deep Sea Alarm from the 1950s belongs to the most important watches of Jaeger Le Coultre’s history.

Other important milestones include the Atmos, the Polaris memovox 1968, the Reverso of the 1930′s. In fact the deep sea is so important that JLC brought out a re-edition to pay homage to the Iconic original (main picture). The re-edition was brought out in 2012 and made in 359 pieces. They all sold out quickly.

For collectors of diving watches – this watch is a must have.

The only minor problem we have noticed with this watch- is that the hands do not seem to be original and we are also not sure of the two winding crowns either.

According to Antiquorum the hands are original but our research indicates otherwise (we have talked to an expert on JLC and looked the re-edition which carries different hands). The most valuable part of the watch, the dial, bezel and movement appear to be original. This is important and valuable.

We think the estimate of Antiquorum is fair (USD 14-20’000) perhaps even conservative and if the watch sells within the range the buyer can be pleased with the result.

For more information on Lot 320- the LeCoultre Deep Sea Alarm from 1960 click here.

(main picture credit: Antiquorum)

Vintage Rolex: Stronger than ever

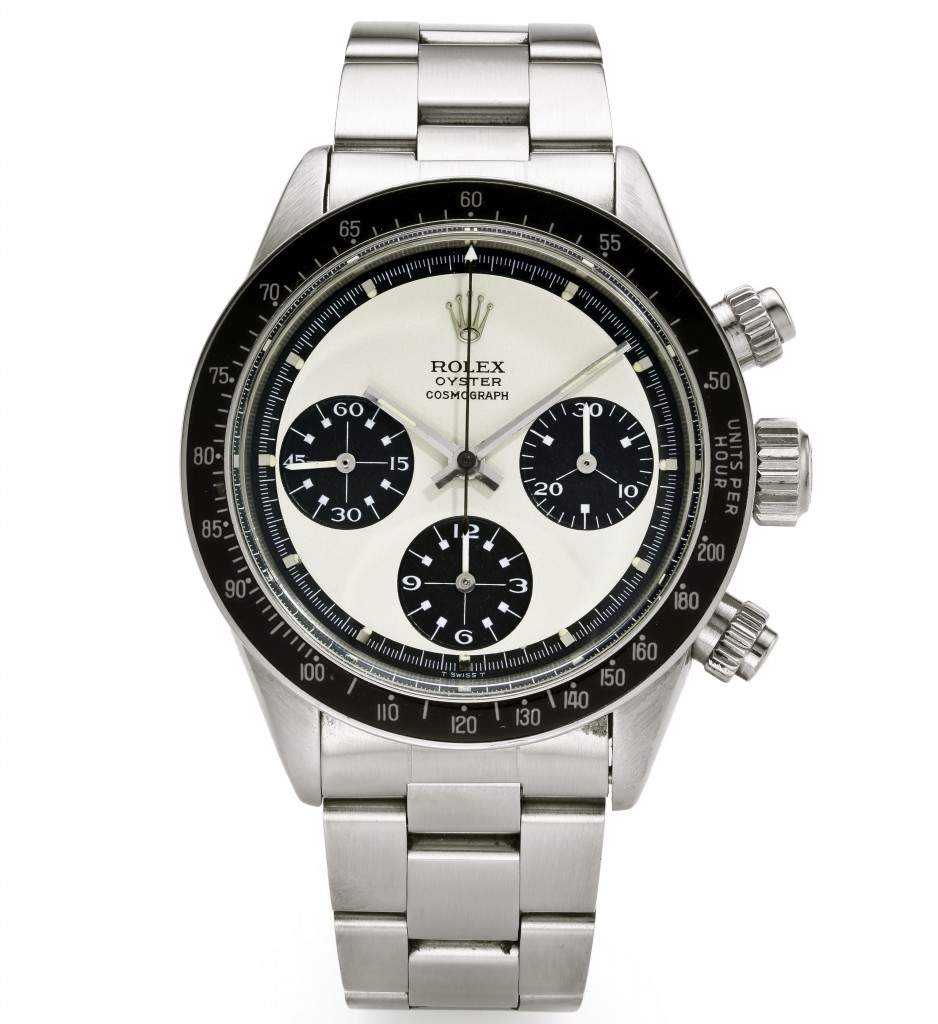

What do you get when one of the most sought after watches in the world, sells with box and papers and better yet- comes from the original owners family?

A near record price for the watch.

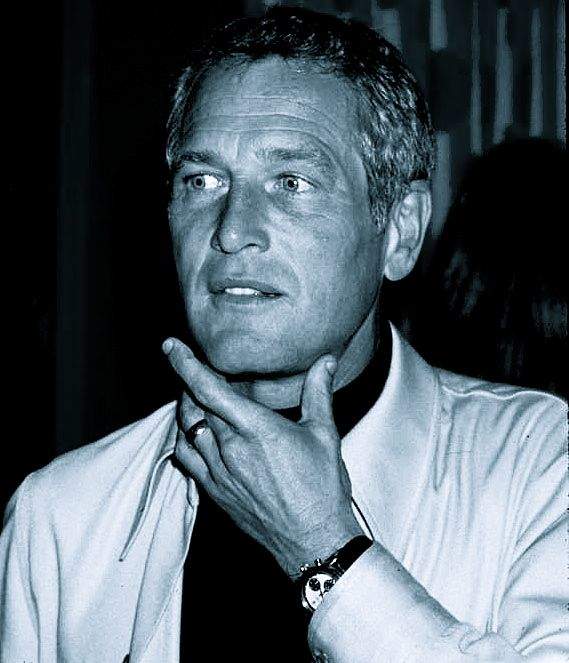

The watch we are talking about is the Rolex Daytona Paul Newman – made famous by the legendary actor who appeared in films like Cat on a hot tin roof and sundance kid. Paul Newman had numerous hobbies besides acting and loved racing cars- this was the actors primary hobby (along with making homemade marmalade).

It was only natural that Paul Newman took a liking to the Daytona Rolex (named after the famous racetrack in Florida). Rolex marketers of course jumped all over the connection between Newman and the Daytona watches he collected. Rightfully so, because what better why to authenticate a watch than to have one of the most iconic American actors wear them while he was racing cars.

The above watch Ref 6263 made in 1971 is especially sought after with the white dial and black circles contrast. Estimated at CHF 65-85’000 the watch ended up selling for more than 3x the low estimate hammering at CHF 212’500 at the Geneva sale in March of Antiquorum.

That’s right.

Nearly a quarter of a million USD for a watch that was a failure when introduced and could be bought for as little as $300 in the 1980s. For more details of the watch click here. If you interested in learning about Paul Newman and the Daytona connection we recommend this blog here.

Concluding thoughts

In our post in December titled ‘Is Rolex finally catching up with Patek‘ we noted the strength of the Rolex market in 2012.

This trend looks set to continue as collectors pay whatever it takes to buy the best lots, that come from the original owners family and with box and papers. You see Original Owners family is valuable because it to some degree ensures that the watch remains in mostly original condition.

So we see no reason why Rolex cannot continue to set records. For Lots that are in top condition and come from the original owners family – record prices are virtually assured.

The return of private equity?

While the Dow Jones has hit new records several times this week, I have been following another headline in the financial markets.

That of private equity.

This past month has witnessed some very large Private Equity deals, which we have not seen since 2007, which in hindsight marked the peak of the last financial bubble.

$24.4bn to take Dell private (led by the founder Michael Dell and Silver Lake Partner), $28bn for Heinz Ketchup (led by 3G Capital and Warren Buffett) and Comcast is paying almost $19bn for the 49% of NBC Universal it did not already own. Only one year ago a deal bigger than $10bn would have been unthinkable. Now $20+bn seem quite easily financed.

Well what has changed? In one short word- confidence.

For one the US economy has improved.

Unemployment is improving, the housing market is rebounding for the first time in years and institutional investors are looking for higher yields on their money. One way to find the higher yield is to finance these private equity transactions which offer yields higher than corporate or sovereign bonds.

Confidence has returned to the credit markets and it is likely we will see more $5-10bn leveraged buyouts in the coming months. Shares of private equity firms like KKR, Blackstone, Carlyle Group and Apollo Global Management have all exploded this year (see table below) as the market anticipates a strong rebound in dealmaking and leveraged buyouts.

This has helped other firms that profit from private equity resurgence as well, firms like Lazard, Greenhill that advise on private equity transactions but also firms like Oaktree Capital that specialize in buying the debt of the companies that are being taken private.

With dealmaking having returned, private equity values having risen, the big three private equity firms are returning records amount of capital back to their shareholders (see table below). With every one and their grandmother looking for yield in the current equity market- private equity firms are clearly providing it. Just look at most firms which are listed in the public markets.

They are offering dividend yields which are mouthwatering.

But there are some experts that are warning of signs another bubble is being formed.

At the Berlin Super Return conference last month, private equity founder Leon Black of Apollo Global warned that ‘loans are abundant’ and that record low interest rates are creating a boom for high yield bonds or ‘junk bonds’ which private equity companies use to finance their takeovers. Howards Marks who heads Oaktree Capital has voice similar concerns of pre-crises behavior. Mr Marks thinks the fact that high yield bonds yield less than 6% is a good sign of the current ‘imprudent behaviour’. While we are still far away from the $40bn + deals that took place in 2007 (like KKR’s TXU buyout), the private equity market has clearly come back strong.

The best evidence of that is found in the public markets where most private equity groups now trade in.

Shares of the private equity groups have surged this year and so have the payouts to their investors.

Dealmaking has returned and as long as interest rates remain low, credit markets open and confidence among businesses high, more $5-10bn private equity deals will get done before this year closes.

Kidston: A ‘heavyweight’ speaks his mind

In the classic car market you can count the top international dealers worldwide on perhaps one hand. One of them is Simon Kidston, based in Geneva, Switzerland.

Celebrating this year his 25th in the business, Kidston is simply everywhere in the classic car market.

Being the commentator and advisor to Europe’s most prestigious concours d’elegance at the Villa d’Este Concorso d’Eleganza, Mr. Kidston is also the commentator at the most famous car rally of them all, the Mille Miglia, in Italy.

Fluent in several languages, Mr. Kidston travels the world to find the top cars for his international clientele (that includes LME). There is hardly a model that Mr. Kidston has not sold and he has arranged new caretakers for cars like the Ferrari 250 Cal Spyder, the 250 LM, 250 SWB, Aston Martin DB4GT Zagato, and numerous significant Lamborghinis to name but a few.

In between arranging ‘Private Treaty Sales’ for his clients Mr. Kidston also writes monthly columns for ‘Classic Cars’ magazine and Keith Martin’s ‘Sports Car Market’. What sets Mr. Kidston apart from others in the business is that he is also a collector at heart and can be seen driving his 300 SL Gullwing, Porsche Carrera 2.7 RS and Lamborghini Miura SV regularly.

For a feel for the classic car market and where it’s heading – please read on:

LME: How do you see the classic car market developing this year, 2013?

Kidston: I think that contrary to my own expectations of the beginning of the year, the strong auction results at Arizona have clearly set the tone: new records were broken and I see the classic car market looking bullish for the foreseeable future.

How do you see the market in 2020? Where is demand coming from? Which brands will be sought after? Same as today?

Kidston: Between now and 2020 I believe we may well see a correction in the market: when, I don’t know, but no market goes only one-way forever. Longer term I’m optimistic. The top ranked collectible cars like the 250 GTO, the 8C 2.3 and 2.9 Alfa Romeo will remain saleable and I expect that values for those cars will be higher in 2020 than now.

In 2020 demand will be coming from China, the Middle East and Russia which is just now starting to appreciate collectable cars. The brands that will be sought after are the usual suspects: Mercedes-Benz, Aston Martin, Ferrari. These brands are strong, have a rich history and are recognisable to new collectors.

You have been in this business now for more than 20+ years. What has changed in this time frame?

Kidston: The business of buying and selling classic cars – these fundamentals are very much the same.

Ownership history or provenance, originality of the car, brand name and model- these factors still determine the value of the car.

What has changed is the balance of power. Where England used to lead the collector community , the US has taken over – because of the enormous wealth created in finance, real estate and technology. Of course the Internet has changed the way people are doing research and purchasing cars (probably for the worse).

Today people with an internet connection claim to be experts on Ferrari, for example, and have little hesitation in spreading misinformation. The personal touch has been eroded with the internet, but this applies less to the top end of the market where deals are still done between people, not computers.

Did you always know you that your profession would involve classic cars?

Kidston: No. When I was young I was more interested in music, although it was the 1980s and you didn’t have to play an instrument to be in a band. That idea didn’t last long. It was only after leaving school that I become more interested in classic cars rather than new ones.

My father was a lifelong ‘car guy’ and this influenced me, but he always bought the newest and fastest (but never flashiest). If a new model came out that was more efficient than the car he had, he would buy the new car. When I was young I was given a modest budget which allowed for a Renault 5 or, as I discovered, a (very) second hand Aston Martin. When I inquired about the insurance cost for a 17 year old with a new driving licence and a 150mph Aston- that dream quickly faded.

What was the most memorable car (s) you have ever sold?

Kidston: In 1992 I sold a 250 LM at Coys which was my first big auction sale of one of my dream cars. My first big private sale was a 250 SWB Competition berlinetta for £440k on Valentine’s Day in 1992. I also sold one of the many Batmobiles from the 1960s- that was fun, as my boss was arrested driving it down Knightsbridge (not a good idea with no licence plates and a Bat Chute scaring followers). The police confiscated the car…

You have a special relationship with Mercedes-Benz. You own a 300SL gullwing. What is so special about this car?

Kidston: My father had one new and he reminisced fondly about it. The 300SL Gullwing was a car I dreamt about when I was a teenager. I then realized my dreams seven years ago and bought a 300SL Gullwing in factory black.

There is some concern among collectors because the classic car market is so strong that some buyers today are not passionate collectors but investors looking to profit from the high prices. Do you see this as a concern?

Kidston: I think there is a lot more speculation than people admit. The speculators however are mostly focused on certain brands- especially Ferrari. The 275 GTB/4, California Spyder, Daytona Spyder and of course the 250 SWB. In a strong market like we have today, people forget that down the road there may be risks lurking. At the moment everyone is making money in this market, not just the dealers but also the owners, and people have short memories.

Do you see value in the classic car market? Maserati comes to mind? What other brands?

Kidston: Pre-war cars like Rolls-Royce offer excellent value. They are rare and beautifully built. Maserati also comes to mind. In the 1950s and 1960s, Maserati cars were built just as well as Ferrari. It is just that the brand today is less an obvious choice than Ferrari. A ‘count’ would drive a Maserati back then whereas the ‘playboy’ probably drove a Ferrari.

My blog is about watches and cars. Do you like watches as well?

Kidston: Yes, I love watches. I received a lovely 1950s Patek from my father which I sold to buy a car (a FIAT Dino Spyder). In the meantime the watch is worth ten times more than the car. I am still learning!

Patek in the watch world occupies the Nr 1 position in terms of records achieved at auction. Ferrari occupies the similar position in cars. Why is that? What does Ferrari have the causes people to be so emotional about the brand?

Kidston: The Ferrari brand is very strong because it is well managed but also because it has a colourful, single-minded history behind it thanks to its founder. Ferrari has been good at benefiting from rising prices and their Classiche department (the classic car arm of Ferrari) has given new collectors confidence- at a price. Today people buy brands and people stick to names they trust- Ferrari fits this way of thinking very well.

In finance there is the Dow Jones 30 Industrial Average with 30 of the blue chip stocks. How would a blue chip car index look like? (300SL, 275 Ferrari, DB5 etc)?

Kidston: All of the above and Bugatti 35 Type, Alfa Romeo 8C 2300 Spyder, Ferrari 250 GTO, Ferrari 250 SWB (this list is by no means complete).

Today with the availability of the internet people can do much of the research themselves rather than rely on expertise from outsiders. What makes your services special? Why do so many collectors (including LME) still rely on expert advice?

Kidston: A good buyer will make an informed decision and that involves speaking to other collectors, speaking to trustworthy experts. They should seek informed and objective advice.

With investments, if I want advice I do not go to the internet to get it. I go to different banks or asset managers, preferably those recommended by friends, and seek expert opinion. The same should be the case with the classic car collector looking to buy a car. He should seek trusted advice from a professional, and personal recommendation is worth more than any advertisement or website.

Sooner or later the collector will find the right expert with whom he can build a long term relationship, and then the enjoyment really begins.

Now I ask Kidston to respond spontaneously. He can chose one or the other or both:

- A day with Enzo Ferrari or Ettore Bugatti? Ettore Bugatti

- Sean Connery or Roger Moore as 007? Roger Moore

- 250 GTO or a 250 LM? Both

- To see Goldfinger or Thunderball? OHMSS

- To have lunch with M. Thatcher or W. Churchill? Churchill

Japan: evidence things are changing?

Twenty three years is a very long time to wait. But there are hopeful signs that the Japanese Equity Market maybe finally breaking out of its long term bear market.

The Nikkei 225 reached its peak in 1989 and then collapsed under their banks which had counted on property prices to continue rising. At one point during the late 1980s Japan’s imperial palace in Tokyo and its land (1’300 sq meters) was worth more than the entire real estate value of California. Japanese investors owned Rockefeller Center in NY and companies like Sony were on top of the world (remember the walkman). Matsuda (a Japanese businessman) owned the largest collection of Ferraris in the world and the Japanese dominated the Forbes billionaires list. But much has changed since then. Japan’s policymakers failed to fix the problems of the Japanese economy (lifetime employment, uncompetitive corporations and mounting debt) and Japan entered what is widely seen now as their ‘lost decade’ where GDP barely grew between 2000 and 2009. From a high of 38’900 in 1989, the Nikkei 225 currently stands at 12’300 which is a drop of nearly 70% over a twenty three year period.

However finally there are signs that the new Prime minister Mr. Shinzo Abe understands that radical measures are needed to get Japan out of this deflationary cycle and on a growth path once again. Japan has targeted an inflation rate of now 2% (this was previously unheard of), and has pursued aggressively monetary policy-that of easing. There is evidence that the financial markets are responding to the new policy measures. Any guesses what the best performing equity market is in 2013? Is it Japan’s benchmark Nikkei 225 Average which is up 18% year to date. However the policy measures have also drastically weakened the yen – so investors have better hedged their Japanese equity bets! – (Macro hedge funds have one main bet right now which they are actively trading: Shorting the Japanese Yen against the USD which has been an immensely profitable trade this year).

Concluding thoughts

There have been many times where we thought Japan would finally rebound and that Japanese equities would recover, but only to fall back to depressed levels. While investing in Japanese equities is tricky because of different accounting standards and valuation concerns (Japanese equities are expensive on a PE basis despite poor corporate governance), we would advise investors who want to buy into Japan to trade Japan through ETFs. One well known, large and liquid ETF is the i-shares Japan (ticker EWJ). Another -perhaps for some investors a better ETF- is the Wisdom Tree Japan Hedged Equity fund ETF (ticker DXJ). This ETF allows investors to profit from the rise in the Japanese equity markets without giving away their gains due to the Yen weakening.

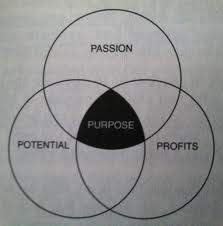

The Profits of Passion.

There was an interesting (and perhaps controversial- just look at the title ‘The Profits of Passion‘) article in the FT weekend edition. It compared the returns of various collectibles over the past ten years.

Let me share a few insights with you.

Out of the 8 areas analyzed Classic cars performed the best with an almost 400% return over the past ten years.

The only investment (if you can call classic cars an investment) that performed even better was Gold that returned 434%. Below are the returns compiled by the Financial Times.

I have added the S&P 500 and the Euro Stoxx 50 also because I think this gives a better all around picture. After all there is always an opportunity cost of money and financial assets (such as equity investments) must be included.

10 yr period through 2012 3Q

- Gold 434%

- Classic cars 395%

- Rare coins 248%

- HK Property 221%

- Stamps 216%

- Sao Paulo Prop 211%

- Fine Art 199%

- S&P 500 Index 115%

- Watches 79%

- Euro Stoxx 50 61%

The article in the FT shows a growing trend of viewing collectibles as an investment.

But like with many statistics and articles, it is important not to take everything at face value. With that in mind lets take a closer look at the numbers and time period.

The FT measured the returns over the past ten years. In the beginning of 2003, the world economy was still recovering from the severe financial downturn, and investors have since put substantial assets in to tangibles such as classic cars. So we are not surprised to see the classic car market perform so well over that timeframe.

But how is the classic car market measured?

The FT used the HAGI Top Index and although the FT did not break down what the percentages are inside the index, I have taken a closer look. Firstly, Ferrari heavily weights the index. Out of the Top 10 models in the index, four belong to Ferrari. And no other brand has received more money (some of it surely speculative) than the classic Ferrari market. So why are we pointing this out? Because if you exclude the heavy weighting of Ferrari, the classic car market would have not performed that strongly and the figures would look different.

The second important observation from the article is the return on watches. I am not sure what the AMR Watches Index is made up of but we can assure our readers the following: Taking a simple average of vintage watch market and including Iconic models like the Rolex Ref 6538, 6536/1 , 1675, 6542 and 6263, a pre-moon Omega Speedmaster professional (like a 2998), an original JLC Reverso from the 1930′s and lastly a 1968 JLC Polaris- the returns over the past 10 years would be substantially higher than 79% (our estimate would be 250-350%).

Lets look at the collectable watch market from a different angle: In 2002 Christies sold $8m worth of watches with approximately 2250 lots. Ten years later, in 2012 Christies sold $126m of watches with a similar lot size. Now while not every watch has increased 16x fold in value, and even though Christies have taken market share away from other auction houses, the point is: The value of important vintage watches has increased substantially over the past ten years and the 79% figure in the article seems substantially too low.

One of the most important figures in the vintage watch world has told me the following: The average price for grade ‘A’ collectable watches over the past ten years is roughly 4-500%.

I bet that going forward the main table above (with the percentage returns) will look very different for the next ten years. While I am bearish in the near term on global equities, I believe that over a ten year period the returns will improve drastically.

Why are we pointing this out if the article is mainly about collectibles?

Because in a period of low interest rates and an uncertain global economic outlook, substantial capital has poured into tangible assets like collectible watches and classic cars at the expense of equities. While the returns of these collectibles are attractive over the past ten years, we believe going forward, these nice returns will unlikely be repeated. In any case we at I think that first and foremost, collectors should collect out of pure passion and not out of any other reason. If collectors make money from their hobby, it is a nice side effect but it should not be the ‘reason d’être’.

The past 10 years have been unusual due to the two big severe crises we have witnessed. This along with two years of record low interest rates have distorted returns from collectible assets.

Once interest rates rise to long-term averages of 3-4% the market returns for collectibles might look different. It will shake away the speculators who are trying to profit from strong prices and leave the market to the true collectors that collect out of passion.

And that will be a good thing.

(Source: Profits of Passion, FT Weekend Edition, by Teresa Levonian Sunday February 24, 2013. Returns on property v high-end collectables – FT.com)