There was an interesting (and perhaps controversial- just look at the title ‘The Profits of Passion‘) article in the FT weekend edition. It compared the returns of various collectibles over the past ten years.

Let me share a few insights with you.

Out of the 8 areas analyzed Classic cars performed the best with an almost 400% return over the past ten years.

The only investment (if you can call classic cars an investment) that performed even better was Gold that returned 434%. Below are the returns compiled by the Financial Times.

I have added the S&P 500 and the Euro Stoxx 50 also because I think this gives a better all around picture. After all there is always an opportunity cost of money and financial assets (such as equity investments) must be included.

10 yr period through 2012 3Q

- Gold 434%

- Classic cars 395%

- Rare coins 248%

- HK Property 221%

- Stamps 216%

- Sao Paulo Prop 211%

- Fine Art 199%

- S&P 500 Index 115%

- Watches 79%

- Euro Stoxx 50 61%

The article in the FT shows a growing trend of viewing collectibles as an investment.

But like with many statistics and articles, it is important not to take everything at face value. With that in mind lets take a closer look at the numbers and time period.

The FT measured the returns over the past ten years. In the beginning of 2003, the world economy was still recovering from the severe financial downturn, and investors have since put substantial assets in to tangibles such as classic cars. So we are not surprised to see the classic car market perform so well over that timeframe.

But how is the classic car market measured?

The FT used the HAGI Top Index and although the FT did not break down what the percentages are inside the index, I have taken a closer look. Firstly, Ferrari heavily weights the index. Out of the Top 10 models in the index, four belong to Ferrari. And no other brand has received more money (some of it surely speculative) than the classic Ferrari market. So why are we pointing this out? Because if you exclude the heavy weighting of Ferrari, the classic car market would have not performed that strongly and the figures would look different.

The second important observation from the article is the return on watches. I am not sure what the AMR Watches Index is made up of but we can assure our readers the following: Taking a simple average of vintage watch market and including Iconic models like the Rolex Ref 6538, 6536/1 , 1675, 6542 and 6263, a pre-moon Omega Speedmaster professional (like a 2998), an original JLC Reverso from the 1930′s and lastly a 1968 JLC Polaris- the returns over the past 10 years would be substantially higher than 79% (our estimate would be 250-350%).

Lets look at the collectable watch market from a different angle: In 2002 Christies sold $8m worth of watches with approximately 2250 lots. Ten years later, in 2012 Christies sold $126m of watches with a similar lot size. Now while not every watch has increased 16x fold in value, and even though Christies have taken market share away from other auction houses, the point is: The value of important vintage watches has increased substantially over the past ten years and the 79% figure in the article seems substantially too low.

One of the most important figures in the vintage watch world has told me the following: The average price for grade ‘A’ collectable watches over the past ten years is roughly 4-500%.

I bet that going forward the main table above (with the percentage returns) will look very different for the next ten years. While I am bearish in the near term on global equities, I believe that over a ten year period the returns will improve drastically.

Why are we pointing this out if the article is mainly about collectibles?

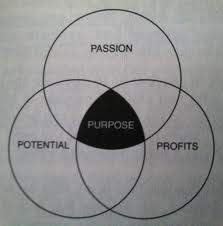

Because in a period of low interest rates and an uncertain global economic outlook, substantial capital has poured into tangible assets like collectible watches and classic cars at the expense of equities. While the returns of these collectibles are attractive over the past ten years, we believe going forward, these nice returns will unlikely be repeated. In any case we at I think that first and foremost, collectors should collect out of pure passion and not out of any other reason. If collectors make money from their hobby, it is a nice side effect but it should not be the ‘reason d’être’.

The past 10 years have been unusual due to the two big severe crises we have witnessed. This along with two years of record low interest rates have distorted returns from collectible assets.

Once interest rates rise to long-term averages of 3-4% the market returns for collectibles might look different. It will shake away the speculators who are trying to profit from strong prices and leave the market to the true collectors that collect out of passion.

And that will be a good thing.

(Source: Profits of Passion, FT Weekend Edition, by Teresa Levonian Sunday February 24, 2013. Returns on property v high-end collectables – FT.com)