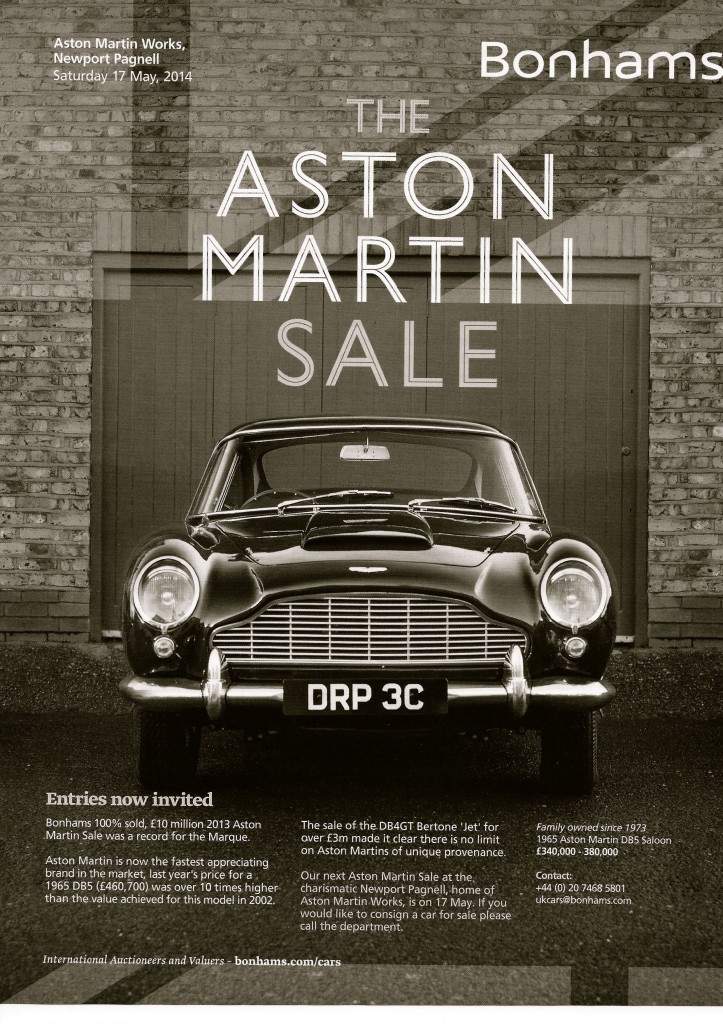

We were going through the newest edition of Classic & Sportscar magazine April 2014 when something caught our eye.

It was the fine print below of a Bonhams advertisement. ‘Aston Martin is now the fastest appreciating brand in the market, last year’s price for a 1965 Aston Martin DB 5 was over 10 x higher than the value for this model in 2002.’

There are a few things worth commenting on in this short sentence.

1) ‘The fastest appreciating brand’? – We would disagree. That honor belongs to Ferrari. In the past 3, 5 or 10 years no brand has risen faster and higher in terms of value than vintage Ferrari. 2) ’10 x higher than in 2002′? While classic cars have appreciated tremendously over the past ten – twelve years, we doubt that DB5′s were only £45′ooo-46′ooo in 2002. Having said that, the Bonhams statement is not that far off the mark. Classic cars have risen tremendously in value in the past dozen years. But we have to remember that in 2002/2003 the world was a different place. The economy was in recession-still recovering from the technology bubble. Interest rates were 4% in the US in 2002 and so the opportunity cost of money was very different back then.

Why are we commenting on the Bonham’s advertisement?

Simply because we find it peculiar that a major auction house is talking about classic cars from an investment perspective. Bonhams is certainly not alone in doing this, other auction houses have done this and dealers are long known to talk about ‘attractive investment opportunities’ when it comes to classic cars. Indeed many collectors, dealers, insurance experts and brokers of fine cars are treating classic cars as an asset class like other high- end collectibles. One well-known dealer last month compared classic cars to fine art.

To be honest we find this trend a little concerning. Classic cars have done very well for their owners in terms of financial appreciation but this should not be the primary reason why collectors buy them. After all classic cars are very expensive to maintain. Not only the maintenance cost of running the car is expensive but also storing it, insuring it is very costly. That is something auction houses and dealers rarely talk about. Although we have nothing against classic cars having done well from a financial perspective (quite the contrary actually), we find it alarming when the industry puts a primary emphasis on this.

Rather we think the biggest advantage of owning a classic car was best summed up by David Gooding.

‘Unlike other collectibles, classic cars are three dimensional objects. You can sit in them, touch them. You can fire them up and hear their sounds. People really get emotional about cars.’

(The main picture is an advertisement by Bonhams auctions. All the content and credit belongs to Bonhams)