Think of a blue chip classic car and what would you come up with? Probably a Mercedes 300SL Gullwing? A Ferrari 275 GTB? An Aston Martin DB4 or DB5? A Porsche 356 Speedster?

All these cars share several commonalities.

Firstly they are on the dream list of most classic car collectors. Secondly they were made in enough numbers that you do see them at classic car rallies around the world. Thirdly and most importantly they do come up for auction now quite regularly. The models listed above are all liquid cars that are bought and sold on a regular basis.

So if we would take one of the models as a benchmark for classic car returns- it would be perfectly acceptable. Of course it would be better to take all of the above but since we have only one (but interesting) data point we are going to take the Ferrari 275 GTB as a benchmark.

Please take this exercise with a grain of salt. We are only using one data point and only one model so obviously the reliability of this exercise can be questioned! But this blog post is not about calculating standard deviations or sifting through data (we leave that to bankers) but merely provides a fun exercise.

So how do the returns look like for a Ferrari 275 GTB?

Well using an advert we found in a classic car magazine (see here) the price listed for a 275 GTB in 1995 was £120′ooo. That is equivalent to $192′ooo in 1995 exchange rate terms. Take todays values of 275 GTB and you get an average price of $2.5m. That is a return of 1200%. This equates to a 13.6% annual return!

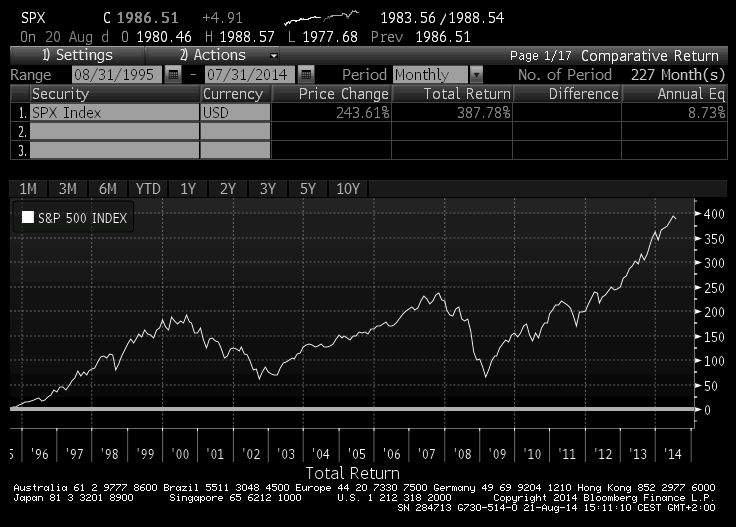

How does that compare to the equity market? Since we are talking USD lets take the S&P 500 benchmark index. Over 20 years the return of this index was 8.7%annualized or 387% total return (see chart below). On these figures alone the classic car index has massively outperformed the equity market index by a margin of more than 3:1 – in terms of total return!

But the returns of classic cars omit one important factor.

Maintenance and upkeep. Insurance, storage costs and maintenance are not included in car prices. These expenses can be quite large and should be factored in when owning a classic car. Simply looking at price returns gives a wrong picture. But even factoring in these costs, classic cars have been good investments for their owners.

However the biggest returns owners of classic cars get should not be monetary but rather intangible.

The senses of hearing a V12 Ferrari start up or the smell of the carburettors- driving these machines- this should give the owner the biggest return that cannot be measured with money.