Financial markets in the US have had their worst five day start to the year since the 1920s. I think it is a sign of things to come.

I was bearish last year (see note here) and the year before, perhaps I was too early. However my bets that the US market would fall are finally beginning to pay off (I am still partially short the S&P 500, Dow Jones, Russell 2000 as well as the Nasdaq Biotechnology index). Despite the markets being slightly negative last year and even with this correction of 5-7% I am still not positive at least not in the US equity markets.

Everybody seems to be pointing the finger to China.

In my view China is not the major problem for now. The problem lies more with Federal reserve and their monetary policy (which was not wrong per se) but has, unintendedly, created a bubble in asset prices across the world. Prices are high not only in financial assets (bonds, equity, high yield, credit markets) but also in collectibles (classic cars, vintage watches not to mention art).

So how is an investor to position himself going forward?

I think the key is to be extremely well diversified. 2016 will be the year where you should think about how to avoid losing money rather than making it. This means avoiding many sectors that are expensive.

Lets start with areas which I see opportunity. For in every bear market there is always opportunity.

I see value in Emerging markets. In fact I am going to call the bottom of emerging markets right here. While they could go lower in the coming months, I see Emerging markets outperforming most other asset classes this year. I made the same call last year but was wrong. This year I am making the same call again. Investors can play Emerging markets via the Vanguard Emerging market ETF (VWO).

I also see value in Energy.

I think this sector is tough to call – as only God knows where Oil prices are heading. One thing is for sure – everybody hates Energy right now (see chart below) and the sector is oversold. I also think oil prices could rebound however I think it is too early to call a bottom in the oil prices yet (I am not that foolish to predict where oil is heading). However take a long term look at oil prices. It is extremely oversold. It is due for a rebound and this could well be the bottom for oil in the short term (oil is priced at $31 brent crude). I think European markets also offer value – especially the UK Equity market which is exposed to oil and mining.

I see value also in European luxury companies like LVMH. While everybody is scared of China – I see opportunity in Casino companies there like Wynn Resorts which has big operations in Macau. These companies are trading at attractive valuations – China wants to bolster their consumer economy as their export sector takes a hit. This should help Wynn Resorts. I also think financial companies that can invest in credit will do well in 2016 – and Blackstone a well diversified alternative manager should hold up well at current levels of $25.

Areas to avoid?

I would avoid technology and think the sector is overvalued (Adobe, Facebook, Amazon, Netflix). If your brave you can short this sector via an ETF called PSQ. I would also avoid or short the consumer discretionary sector via an ETF called SZK. The valuations in consumer names like McDonalds, Coca Cola, Pepsico and Kimberly Clark are absurdly high. Another area to short or avoid are US small caps like the Russell 2000 (you can short this via TWM).

Biotechnology is another sector I would avoid for 2016.

To conclude:

I think 2016 will be a difficult year but investors can navigate it through extreme diversification.

I would avoid or go short expensive sectors listed above as added diversification. I also would own some gold as diversification and insurance against Armageddon. If you own US treasuries I would hold onto them – they provide a useful safety hedge. I also would own large cash positions. Especially if your into collectables (art, vintage cars or vintage watches) I think 2016 will present some opportunity as some leveraged collectors get called on their loans or decide to sell given increased uncertainty.

I think 2016 will be the year to avoid losing money rather than making it. And more so today than ever – cash is king.

To help understand my bearish position on US equity markets, lets look at some charts. The recent sell-off seems decent looking at the chart of 1 yr.

The problem is looking at a 5 year chart. We have come a long way in the past five years (see below). This correction is minor when looking at the long term. We could fall to 1800 on the S&P500 which would only be towards the 200day moving average (a healthy mean reversion) even 1600. I would get extremely bullish at 1200 S&P 500 but that is another 36% downside from here. Remember that 666 was the low during the last 2008 economic crises. At 1600 S&P 500 I would consider exiting some short positions.

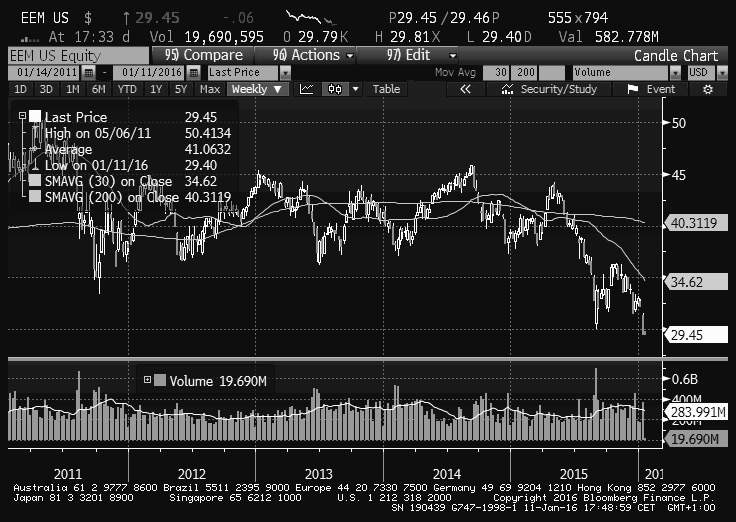

One area I am more confident on is in emerging markets. Look at the levels we are at below. This is a strong sell- off and a good contrarian bet in my view. The technicals look extremely poor and it has to hold the $30 level else there is downside.

The technicals would tell you NOT to buy the emerging markets. And the $30 level should hold else from a technical point of view investors are in trouble. But look at a five year chart. This is a proper sell – off. Nobody believes in Emerging markets anymore. Retail money is flooding out of emerging markets. If your a contrarian investor – not necessarily a bad sign.

Another area I am think could represent opportunity is energy. I don’t know where the oil price is heading. I just know that we are extremely oversold (see chart below). This is the futures chart of the NYMEX WTI Crude.

In 2008 Goldman Sachs called oil to top $200. Now Morgan Stanley is calling for oil at $20 which would match or slightly surpass the inflation adjusted low in 1998 of $8-10 per barrel (see chart below). I really enjoy investment banks analysis. They are a perfect contrarian indicator in my view.

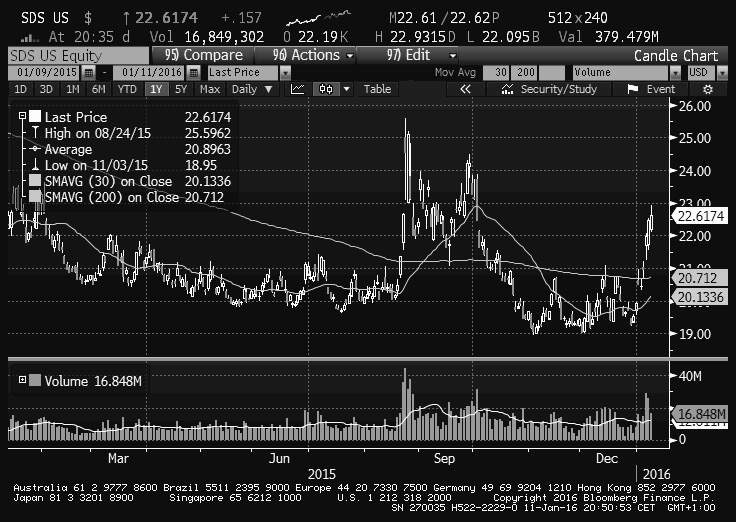

One way investors can hedge themselves is by shorting the S&P 500 using futures or leveraged inverse ETF’s. These are more short term tools as the inverse ETF like the SDS is re-priced daily but I hold on to it for a few months. From a technical point of view the SDS looks very strong and might test September highs (see chart below).

Another area I am short is the Russell 2000 market, or small cap index. I think the valuations will decrease with time and the technical charts of the Russell 2000 look very poor.

Gold will prove useful in 2016 the economies tank worldwide. Gold peaked in 2011 along with the commodities super-cycle so its in a 5 year bear market. If US economic data disappoints and central banks don’t get it right with interest rate policy, Gold might be not a bad place to be (see chart of GLD – the gold ETF below). I for sure prefer Gold right now – more so than the S&P500.

I think Europe, especially the UK equity market the FTSE 100 offers decent value. It is linked to the commodity markets (Glencore, Anglo American, Shell, BP) that have a heavy weighting. But the FTSE has gone no-where in the past five years. On a one year chart it is testing important support levels of 5800 and the technicals look quite weak for the UK market (see chart below).

But there value there with a good dividend yield of 4.4%. Long term support is at 5500 for the UK market so only 300 points below current levels (see chart below). Believe it or not- but the FTSE 100 has gone nowhere for the last 17 years on a points basis.