Geneva May 2018 watch auction analysis: Part I

Fine WatchesCollector's InsightFine WatchesEventsIn the Daytona Ultimatum catalogue opening remarks Aurel Bacs asks us to be the judge if his tennis game (meaning what Phillips watches team has delivered in terms of watches) is up to par with our expectations.

This blog post is an attempt to answer this very question.

(In Part II I will focus on the general vintage market and some trends I saw).

As expected the Daytona Ultimatum sale by Phillips was strong. It was a success at least looking at the numbers.

Just like the Daytona Lesson one sale in 2013 (headed also by Bacs who was at Christies at the time), the sell through rate at Daytona Ultimatum was 100%. Five years ago, it took 50 lots to achieve sales of CHF 12m. Today 32 Lots achieved sales of CHF 22m. In other words, in a relatively short time span of 5 years we have come along way and moved strongly higher in terms of prices. However, data can be misleading if you don’t dig a little deeper.

Here are a few trends and information I want to share concerning the Phillips results and the general Daytona market:

- Quality was first class and once in a life-time for many models : A friend told me on the way to Phillips auction that he has seen several models at Phillips watches that are likely never to appear again for at least a decade. The quality was that strong. At least in terms of rarity and quality – Phillips delivered the goods. I show you what I mean with pictures in the end of the report.

- Prices did not always surprise to the upside : Out of the 31 (I don’t include the unicorn) lots that sold at Daytona Ultimatum, 15 of them sold below the high estimate. Now this is not a bad thing and shows that Phillips for the most part priced their watches absolutely correct. But for an auction that was hyped up to be a once in a lifetime event – the fact that nearly 50% of the watches failed to reach the high estimate, shows that expectations got ahead of themselves!

- Expectations were too high : There was so much euphoria in anticipation of this sale that crazy numbers were being thrown around. Everybody was either buying a Daytona in anticipation of even higher prices ahead or waiting to sell their Daytona but wanted to see what prices this ‘Daytona Ultimatum’ auction would bring. In many ways this auction did not deliver the euphoria that many people were expecting; for example I became aware that one seller (who sold 2 Daytona) in the Ultimatum sale was disappointed with his results. While the auction room was packed – it was missing the energy of the NY sale last November and also the Daytona Lesson 1 sale five years ago. This is what happens when expectations get out of control – it is a set up for disappointment.

- Dealer prices at auction : The next day at breakfast I ran into two of the top dealers for Daytona and Rolex and both said that prices including auction commission were more or less what the dealers were asking in private sales. Usually auction prices especially for Daytona tended be above the dealer prices.

- Zenith porcelain Daytona strong : All owners of the first automatic movement with Zenith movement and porcelain dial can be happy. Results were exceptionally strong for those models.

- Daytona, especially Paul Newman models have become an international currency : I noticed this with all the other auction houses that offered Daytona. Virtually every single Paul Newman Daytona attracted buyers from all over the world. How did I know this? Because often they were bidding online. Saudi Arabia, Russia, China, America, are just some of the countries I saw bidding.

- Market for Daytona is mostly rational today : Don’t get me wrong. The demand is very strong. But buyers know exactly what they are doing. The estimate of the Panda of Christies was simply too high (and not totally correct to have that kind of estimate) whereas their golden 6241 with three lines was stunning. The collector is doing his homework and becoming smarter and more educated.

The Daytona auction at Phillips (but also seeing the prices and sell through rates at other auctions) validated that the Daytona, is at this moment in time, the must have collectors watch.

The Daytona has become a brand within a brand. A separate asset class that enjoys a global following.

I honestly think that the Daytona and Paul Newman have become a sort of global and liquid kind of currency, accepted all over the world. The prices at Phillips reflect this and also the fact that every single Paul Newman Daytona that was half way reasonable in condition at all the auction houses (incl Sothebys, Christies and Antiquorum) attracted buyers from all over the world and brought in solid results.

What are the risks for the brand Daytona going forward?

Well to put it frankly the Daytona is a commodity relatively speaking. There are plenty of them, even the manual wound ones with four digit reference numbers.

All the auction houses jumped on the Daytona band wagon and there were so many Daytona and so many Paul Newman models present in Geneva (not only for sale at auction) that you had to look hard to find a sports Rolex that was NOT a Daytona. And therein lies the problem for the brand going forward – at least on the vintage side. There is only so much the market can absorb.

Many collectors are herd followers – they want something that is liked by everybody and has global acceptance. This is helping the Daytona right now. Yes, the Daytona looks great and it is a super cool watch to have.

But at the end of the day collectors also want to differentiate themselves. They want to stand out from the crowd. And this in my opinion is the biggest hurdle for the brand Daytona going forward in the vintage world. For now, the brand Daytona, is healthy and seems to absorb the supply very well. The results show this very clearly.

Luckily all Daytona are not created equal and so a collector still has plenty of chances to differentiate him or herself. Let us take a look at a few pictures of what I mean.

(I would like to pay my sincere respect to John Goldberger for his incredible gesture of donating his white gold unicorn Daytona 6265 to charity and congratulate him on the superb result for his watch CHF 5.9m. It is now the second most valuable Rolex ever sold beating out the Bao Dai. Also Mr. Sabrier deserves praise as well as the entire team of Phillips watches for flawlessly executing the sale. I congratulate also the new owner of this fabulous watch for his decision to buy it with the proceeds going for a good cause. Phillips watches can be very pleased with their results (and I congratulate them if I have not yet done so) even if the highest expectations of some dealers and collectors were not met in terms of prices – you can’t please everyone I guess).

Sometimes it is best to look at some pictures and let them speak for themselves.

I have long had a weakness for gold Daytona (in fact almost every single Daytona I show in this report is in gold). I just think the pushers look better in gold. Here a 6263 with black dial and gold – which makes for a striking contrast.

This model was a rare 14k version, maybe made for the American market.

The split signature causing the SCOC signature to appear to be floating. The oyster in extra small print. It is all about details in Rolex in the world of vintage Rolex.

They are only 2 known models to have this type of floating signature in a 6263.

Out of estimated 24’ooo Daytona with screw down pushers made (so 6263 and 6265) only 10% are thought to be cased in gold.

Another gold watch that really caught my eye was this pristine 6239.

I loved the case back. This watch sold for a very strong price and it was well deserved.

I thought the buyer (who I briefly met last year) put up a terrific fight and recognised a trophy asset. This watch is worth every cent he paid and more.

The third gold watch that I admit I was obsessed about was this JPS John Player Special.

I am not a Daytona expert but I thought the condition of this watch was incredible. The case was thick and perfect and the dial and subdials in just exceptional condition.

We might never see the likes of a watch in this condition again anytime soon.

It spoke to me and also the market- this watch fetched an outstanding result – just shy of CHF 1m.

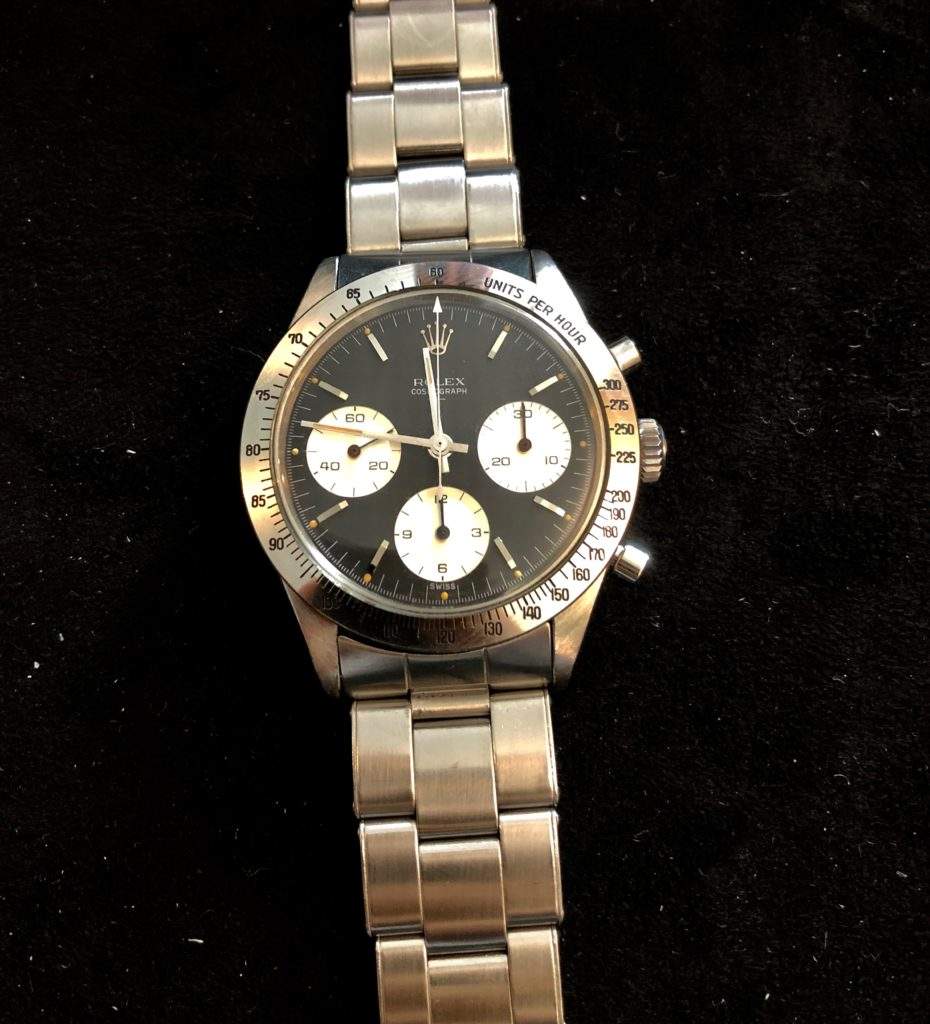

The last exceptional Daytona I noticed, was the Double Swiss. It is the only steel Daytona I would consider buying.

It has everything I like in a watch. History, details (like the Bezel and double signature) and lastly its pure in design. Sold for CHF 275k which must be close to a new record for this reference double Swiss.

Not only Phillips watches had exceptional Daytona.

Christies had a stunning 6241 which had a similar font and style of writing as the 6263 split.

Allow me to show you more.

It had the rare 3 line of signature with oversize Daytona writing. A similar one with screw down pushers was the subject of a PAK watch not too long ago.

This watch was in very good condition and fetched an accordingly strong price: CHF 237’ooo for non screw down in gold is good. Very good.

Another view of this splendid Daytona.

I have been told the main difference is the white graphics on the sub-dials – a feature which makes this watch definitely more attractive. I would be surprised if this does not beat or match the previous record for a lemon dial Daytona which Christies also achieved of USD 871k in May last year.

The last gold Daytona I will show is another 6263 Gold with ‘normal’ dial layout.

I had to try it on and maybe you see why I am obsessed with Gold Daytona in all variations. The material gold so much warmer and more attractive (not to mention rare) than their steel counterparts.

A collector – dealer brought this along and said it was NFS right now.

This report would not be complete if I did not show the one Daytona in steel that was just exceptional* (at least on pictures – I never got to see it in real). It shows that tropical is not only valued in Submariner and GMT models but Daytona too. This steel version almost reached CHF 1m at Sotheby’s – an incredible result if you think about it.

Stay tuned for Part II of the watch auctions.

*Picture credit: Robgio73

(For full disclosure and transparency, I or my trust own a manual wound gold Daytona at the time of writing this report).