A wise investor (and billionaire) once told me the following. He said ‘to be a successful investor you don’t have to be right all the time. You just have to be right more often than you are wrong‘.

In 2016 I was more often right than wrong – despite being short and bearish on the US markets.

This allowed me to post the best gains in performance since 2009. My performance is remarkable given that I had one bet that continued to work against me. I remained short the S&P 500 and the Dow Jones throughout 2016 (even though I sold some of that position). But I was so well diversified that my other bets paid off nicely. Also my timing on many trades proved to be perfect.

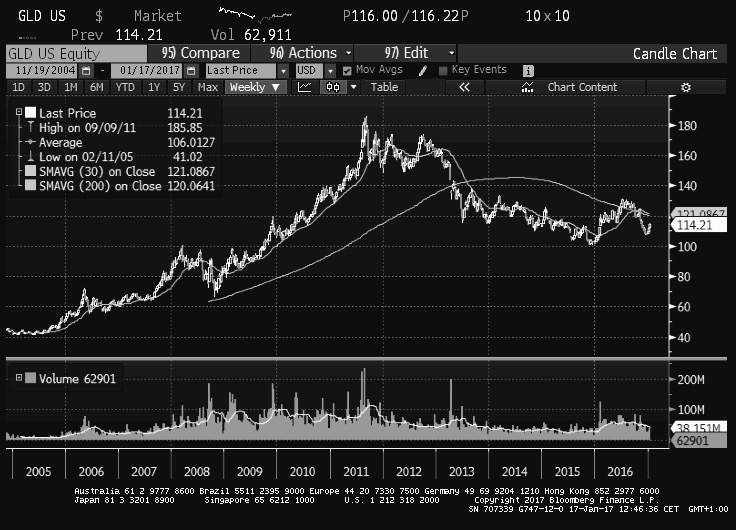

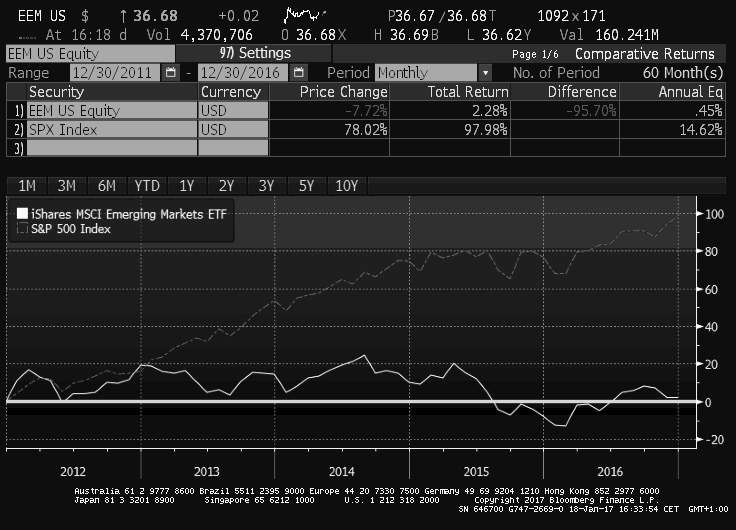

For a start I sold some my short positions on the US equity markets in January when the markets dived and I cut my losses on those positions. I intended to buy them back but never managed to take a full short position again. That was lucky because I was still negative on the US markets in 2016 (which I admit proved to be a mistake). Secondly I bought options on oil when oil was trading $31 per barrel NYMEX WTI Crude. I thought oil might bottom at that level and stated in my investment outlook in 2016 that oil could prove to be an opportunity. It was. I also increased my equity position in energy companies – something I also advised investors to do in 2016. That yielded me very nice profits. I also bought emerging markets which proved to be perfect timing (see chart 10). I stated this in my outlook that emerging markets stocks were cheap. They were. Additionally I was long the right companies like Louis Vuitton Moet Hennessy in Europe and Wynn Resorts (both of which I also publicly stated in my investment outlook and recommended to buy). I avoided many sectors that took a beating (biotechnology) which I also recommended to avoid last year (but am now recommending to buy).

Oddly enough, one of my best trades of 2016 had nothing to do with equities. It was in the bond market where I made what is for sure one of the best trades ever. I normally am not that active in bonds but when an opportunity arises like this – I take it with open arms. I sold my entire position of my 10 year zero coupon US government bond when it yielded 1.49% in late summer 2016 – having purchased the very same Bond only 8 months earlier at a yield of 2.70% (see chart 12) – which I also advised investors to own in my investment outlook – only to buy it back last month at a yield of 2.50% (2.70% zero coupon). I am not a Bond market expert by any means but given the equity markets offer almost zero value in my opinion – having the government guaranteeing a 2.7% pa return on my zero coupon bond is a bet I was willing to take. Especially at current valuation levels in US equity markets.

Not everything worked out in my favour during 2016.

I did not make any money on my gold position (something I am still a believer in) and also lost performance due to being underweight in technology companies which continued to soar to new highs. In Europe I did not hedge my pound positions which gave me a large headache (even though I increased my equity exposure post Brexit decision in the UK). I think the pound remains extremely undervalued today and will not hedge my exposure at this rate. Contrary to the experts – I am long the British pound (very happily so at 1.22 / USD). Lastly my short position on the US equity markets in 2016 was once again a mistake. The US markets performed strongly once it became clear that Trump was the President Elect. My short trade against the US markets have now worked against me for 4 years in a row. Although I normally don’t make the same mistake more than twice – I am not willing to give up on this trade just yet. With tax loss selling and buying my short positions back at lower rates – I have managed to minimise my losses. I still believe in the short trade and have raised my short trade bet to all time high levels now.

In summary, I got many trades right in 2016 more than I got wrong and this led to a very good year in 2016. I feel my confidence is back. I made some bold bets in 2016 and got many of them right.

Here is what I see coming for investors in 2017.

First let me state the obvious. Trump is good for the equity markets and for business. This is clear. His tax reform is much needed and the markets have embraced this possibility. The markets have rallied strongly since Trump was voted to be the next president.

However I think the markets have amply discounted this and here is the biggest problem: The market in my view is not discounting enough what could possibly go wrong. For this reason I remain very negative on US equity markets in 2017. I think the bull market is getting tired and expectations are too high. I remain bearish on the US but do see opportunity elsewhere. Here is what I worry about in 2017 and how investors can protect themselves:

- Trump is good for business but he carries uncertainty: As much as I like Trump (and he had my vote) for US business and tax reform – he has no political or government experience. I think the financial markets underestimate not only his lack of experience but also policies that may not be good for business (trade wars, protectionism) etc. I thus am looking to increase my short position in the US equity markets once again massively. There is too much complacency in US equity markets.

- US markets could correct massively: My best case scenario is that the US markets only marginally decline from here (less than 10% from current levels). However a middle case scenario (and one I am betting on) is that the markets take a 20% correction sometime in 2017. My worst case scenario (one of which I place a 30% chance of happening) is that the markets have a 40% or more correction with the S&P 500 testing 1200 from the current almost 2280. The Dow could test 12’000 which w0uld also represent a 40-45% correction. I am positioning my portfolio to withstand such a correction. You should too. A 40% correction from current levels is something that can happen and would not be abnormal for equity markets. We have not had a significant correction in equity markets in over 5 years (the last one was 2011). See my chart analysis below (see chart 4). I remain short the Dow, the S&P 500 and am looking to short the Nasdaq 100 and the Russel 2000 small cap index.

- The strong dollar will hurt US earnings: I am not sure why the market is not paying attention to the strong dollar – but it will hurt US corporate earnings. With current valuation levels of the US equity markets, earnings will have to be strong or the market is going to take a hit. Another reason I am negative on the US equity markets.

- Rising interest rates are not helpful to equity markets: Either the market thinks interest rates will not nearly rise as much as current interest rates predict in the US, or we have to go and re -write financial modeling books again. Higher interest rates (all else being equal) are negative for equity valuations. When you plug in higher interest rates in a financial models like the dividend discount model or discounted cash flow model you will come up with lower prices. The market is not taking this into account right now.

- I stick with my bet on emerging markets: Even though a stronger dollar is not helpful for the debt of emerging market countries – I think the current valuations of many companies are attractive enough to buy. Televisa (Mexico), Teva (Israel), Infosys (India) and are just some of the large emerging market companies that have strong brands and are all undervalued. I think emerging markets offer a much better risk reward that the US markets (see chart 11).

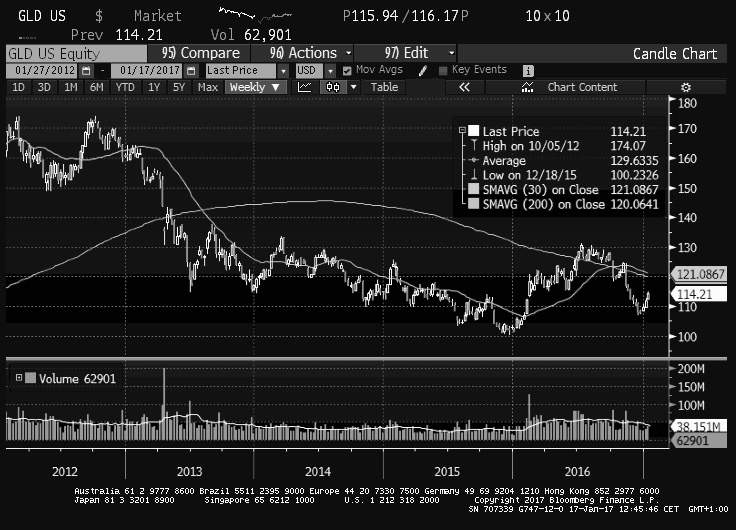

- I think Gold offers good protection against disaster: I view Gold as a good insurance policy against what could go wrong. After hitting 1800/ounce in 2011 Gold has remained in a downward trend as central banks around the world offered investors the promise of easy monetary policy (see chart 7 below). I think Gold offers good insurance against so many potential disasters that could happen. I don’t like gold as an asset class long term – but right now gold offers investors superb protection.

- I think you can hide in Pharma/biotech companies: Although I remain negative on most industries – I think pharmaceutical companies offer decent protection at current levels. I think pricing concerns are fully discounted in the share prices and most global pharma companies offer strong dividend yields that are backed up by strong cash flows. I was negative last year on biotech but even this industry and has corrected enough – and I would dip a toe back into this industry.

- Alternative asset managers still too cheap: I continue to own shares of Blackstone, Apollo Capital, Oaktree and KKR. Although I earned good returns with Apollo, I think Blackstone remains undervalued and I continue to own a large position in this company (this bet did not work in my favour in 2016). Blackstone will continue to benefit from their unique position and dominance in the alternative financial space.

- Energy offers decent risk reward levels: I would not be buying oil right now (that trade should have been done last year which I advised in my last years investment outlook) – but holding on to global energy companies like Exxon Mobil, BP and Occidental should provide decent returns. The dividends seem safe now that oil prices are above $50 again and the OPEC has finally got its act together and are restricting supply.

- Swiss banks and the world remain overweight the US and long the US dollar: I have done well in the past by doing the opposite of what Swiss banks have done. The Swiss banks are notorious for being herd followers and have reactionary investment policy as opposed to a pro – actionary policies. What do I mean by that? Well almost all the Swiss banks are bullish on the USD and are long the US equity markets. Even though the Swiss banking industry is not what it once was – they still manage trillions of assets. They are all overweight the US market and long the USD. They are all playing the same trade. What happens when this trade reverses? I remember when gold was at 1800/ounce in 2011 most Swiss banks told me to have at least 10-20% of my assets in gold. When oil was trading at $140 I remember all the banks were overweight energy and Goldman predicted $200 (Goldman also were the ones to tell me last year at this time that oil cold head as low as $15 / barrel). I use the world banks and brokers as contrarian indicators. When they turn right – I often turn the other direction. I made plenty of money following this strategy. I make any bet with you once the US markets correct 20-30% all the Swiss banks will lower their US equity market exposure (which will cause the markets to fall further). This is a typical reactionary investment approach that most Swiss banks (and global banks) employ. A nimble investor willing to take the other side of that bet can often profit handsomely.

- Biggest frauds take place in bull markets: Right now as we speak, companies are feeling confident. There will be big deals done that should not be done – companies will be overpaying for assets. Somewhere in the US – the next Enron is being created. It is the nature of executives to do stupid things when markets are strong and stable. The next biggest fraud is being created as I write this outlook. And it will shake investor confidence like never before.

- Uncertainty is the enemy of long term investment: If there is one thing I have learned over the past 21 years of investing (not only on behalf of banks, but also for my self) is the following: financial markets hate uncertainty. They always have and they always will. Trumps policies and his administration is full of uncertainty. This will be reflected in markets in 2017 – I am almost certain of it – and that means the US markets will be not only be volatile but they will fall. Expect a significant correction.

Concluding thoughts

It is critical to be extremely well diversified in 2017. That includes hiding in non -correlated assets like Gold but also being short selective overvalued sectors (I would short the small caps like the Russell 2000. I would also short the Dow Transports, and the Nasdaq 100). Being short and extremely well diversified will protect you and allow you to earn some handsome returns should the US markets correct significantly. I would also be hiding once again in 10 year US treasury bonds – once the yield goes back above 2.5% and 3%. Emerging markets will hold up in 2017 and European markets offer better value than the US. I would also hold large amount of cash levels (I continue to hold well over 50%). Sometimes holding cash is much better investment than being invested.

What most investors don’t realize is that it could well be that for the next 10-15 years that US equity markets will offer no returns from current levels. It happened from 1960s to beginning 1980s and it took the Nasdaq sixteen years before it recovered the levels of the technology crash (see chart 6 below). It was only last year where the Nasdaq 100 reached its high of 1999.

I am lucky I work in an industry that employs many people with no behavioural, emotional and psychological intelligence. All the analysts and investment bankers and fund managers are herd followers and happily follow the consensus. This allows me at times to take the other side of the trade and profit handsomely. Yes my timing is not always perfect and sometimes I too am on the wrong side of the trade. But being a contrarian over the long run has allowed me to earn handsome profits.

I am paranoid about 2017 – and not in a good way. Be extremely diversified like never before. And position your portfolio for at least a 20% correction but make sure it can stand a correction of 40% or more.

(Credit main picture: World simplexcity).

Looking at the charts can help us understand how far we have come in financial markets in the US. We start with Dow Jones Industrials – which is a price weighted index. The five year chart looks fine and not exaggerated. (Chart 1).

It is only on a near 20 year basis where you see the massive run we have had.

Technically speaking I see several levels that we could revert too. The first stop would be 18000 but a more important level to hold is 16000 – I think this could be tested in 2017. If 16000 does not hold I think 14000 could be tested. A correction down to 12’000 or a loss of 40% also cannot be ruled out. (Chart 2).

The S&P 500 looks much the same. Over five years not that extended. (Chart 3).

Over a longer time frame of nearly 20 years things look different. At current levels we are clearly extended. The level of 1800 here better hold up or the next stop is down. Way down. I think the next resistance after 1800 is back down to 1600 and then 1400. This would be the average level over the past 20 years (Chart 4).

The Nasdaq broader index is no different. Same story different index. (Chart 5).

The long term chart shows how long it takes for extended indexes to recover. In the case of the Nasdaq it took 16 years to recover the 2000 crash. (Chart 6).

Investors can seek a safe haven in gold. This precious metal remains in a decline and seems to have found a base and bottom in 2016. (Chart 7).

A ten year chart of gold shows that 2011 was a peak at 1800/ounce. The risk off trade and central banks printing money have caused investors to move out of gold. I think gold is attractive at current levels and will offer good protection against a weaker dollar and potential trade wars and protectionism. (Chart 8).

Another area that has been completely ignored by investors are emerging markets. They have recovered off the 2016 lows as the chart shows. (Chart 9).

But longer term over 10 years have not participated in any outfperformance what so ever. Emerging markets are flat over a ten year period. (Chart 10).

The contrast to the US markets is remarkable. Look at the comparison between the S&P 500 and Emerging markets over 5 years. Could 2017 be the year that this trend reverses itself? I think it could. (Chart 11).

The 10 year US treasury bond has lost has gone from a yield of 1.40% at its low to a recent yield of 2.59% all within a six month time frame.

In percentage terms the 10 year bond yield has risen 76% from its July 2016 low. I think the move is too far too soon and the 10 year at best will move between 2.50% and 3% – a level I think is attractive enough relative to the US equity markets that I would want to hide there. (Chart 12).

Lastly lets look at the generic WTI crude market.

For the very brave 2016 was an excellent year to buy oil. I have exited my options on oil and have no opinion where oil might be heading in the future. I think it might be stuck in a trading range but am not willing to take a bet on any direction. I continue to have indirect exposure to oil but owning large integrated oil companies like Exxon Mobile and BP.