Phillips NY Auction results: History was rewritten Part 2

Fine WatchesCollector's InsightFine WatchesEventsIt was to be expected. The atmosphere in the auction room at Philips was electrifying.

I have never seen so many journalists, collectors and so many TV camera’s in an auction room in my entire life. The only comparison I have was in 2013 during the Daytona One sale at Christies (also headed by Bacs at the time). That auction was legendary, but this one topped it in terms of just sheer excitement. While I am still digesting the Paul Newman result, I thought the rest of the auction was healthy and strong but not euphoric. Let me be clear – we cannot read too much into an auction that only had 50 lots. It tells us nothing of the health of the vintage market even if the brands were well diversified. I think we will get a better read in Geneva in a few weeks to measure the health of the vintage watch market.

Here is how I read the auction at Phillips.

(The window display above was very impressive at Phillips. They thought of every detail).

Let me start with Rolex watches since that was also the highlight at this auction.

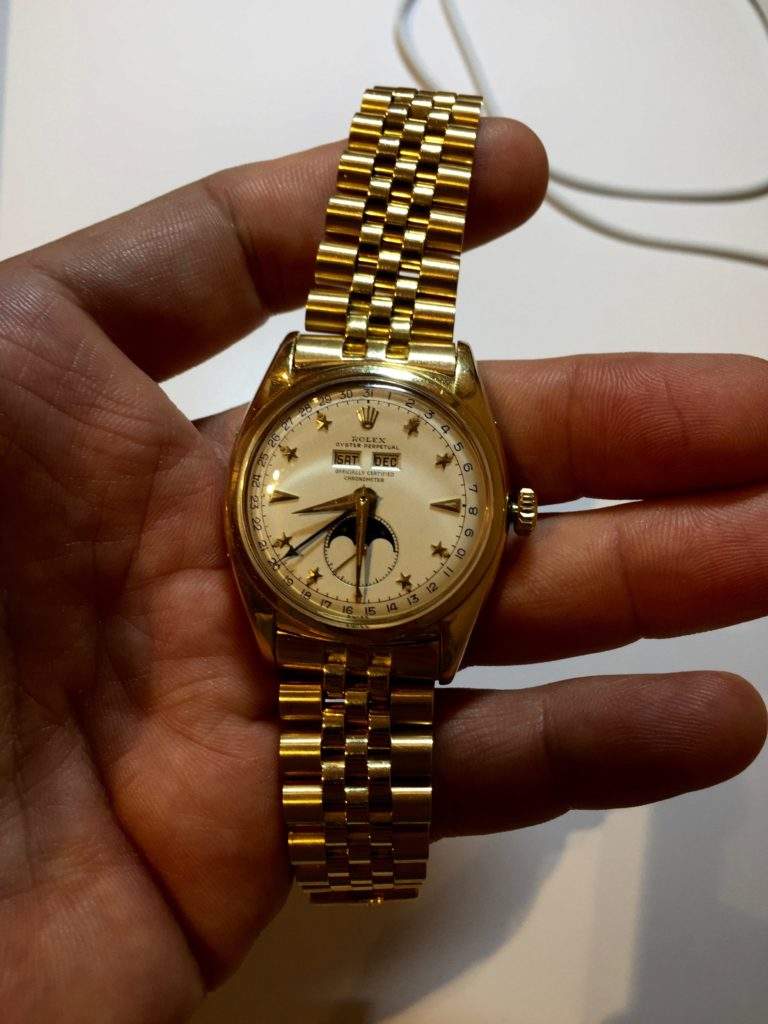

I think the Rolex market remains healthy. I thought the results of the other Rolex watches were more or less what was to be expected. The superb 6200 submariner, that apparently took the collector years of convincing to sell, sold for $579’000. It does represent a new record for the reference but just narrowly so. A well known Rolex expert I talked to (who also writes a well known Rolex blog) – expected significantly more given the rarity of the watch and importance (it is the first big crown and with the 6204, the first submariner ever made by Rolex). The 6062 star dial sold for $495’000 – probably correct. It was a nice honest and correct watch but not extra-ordinary and in that respect that price reflected its condition of lets say an almost 8/10. The 8171 Padelone was interesting with luminous hands and sold for $603k – a strong price but I expected a little more. I saw two areas of weakness within Rolex: Daydates (lot 24) and Rolex watches with stones (lot Nr 40) performed relatively weakly. The other area of weakness was the Rolex Killy just as I had predicted. The Killy continues to be out of favour by the market. Maybe it had to do with the dial being bi-color. The outstanding Killy (it was one of the best Killy I have ever seen) which I give a 9.5/10 sold for $262’000. A fine but normal pump pusher Paul Newman cost that today and you cannot compare the watches in terms of rarity and complication. I am sure the Killy will make a strong come-back (the gold Killy remains in demand and fetches high prices due to their rarity). Lastly the superb NOS 6263 Gold Champagne dial Rolex (a personal favourite of mine) sold for a strong $200’000 but absolutely worth it and correct given it was untouched.

Let’s move on to other brands. Another favourite of mine was the Audemars 5516 which achieved a strong $675’000 and eclipsed the previous record by more than $100’000, even if the condition of this 5516 was not as strong as the Christies watch that held the previous record. I think here it was a question of- find me another one and there won’t be another one. Only 9 made and 6 remain inside Audemars private collection for now. Talking about rarity, the wonderful Cartier tank in Platinum was a little soft in my view, something I also predicted would happen, and sold for $350’000. And the Pateks? Nothing extra-ordinary here. The two blue chip perpetual chronographs of the brand the 2499 and 1518 sold within their estimates. A personal favourite of mine the 3448 white gold perpetual calendar sold for $471’000 also in line with its condition.

Another trend I noticed: Rare and unusual watches fetched very good results. The Cartier crash sold strongly and the wonderful Jaeger DSA (deep sea alarm) with rare Champion and Jaeger signed bracelet did well. As did the Omega Alaska project (there was almost a bidding frenzy on this watch).

To conclude it was healthy sale and most watches sold for correct market prices. Nothing struck me as extra-ordinary except for one thing. The Philippe Dufour.

I do appreciate this independent watchmaker, who according to Aurel, is one of the finest in the world and his finishes on the watches extraordinary according to collectors. Nonetheless, I can’t help notice that this watch was marketed before the sale by various blogs and experts who might have an interest in the brand doing well. Also, many well respected collectors own a Dufour watch and when they appear on the market (the production is extremely limited) they are snapped up by collectors wanting to belong to this club. I compare it a little to the F1 McLaren in the car world. It is pushed by certain well respected collectors and owners and has taken on a myth of its own. The Dufour Duality (which is the first watch ever made with two escapements – even before FP Journes Resonance) fetched an incredible $915’00. If I remember correctly, the watch received an opening bid of $600’000 which is mind-blowing. To put that in perspective it almost fetched the same price as Pateks 1518 in pink gold. That is a strong price and a big compliment to Dufour and the brand of independents. l am curious how long this strength in Dufour will last and if it is sustainable. Time will tell.

Below some pictures of the watches discussed above. First the 6062 star dial that sold only 3 years ago at Sotheby’s for less than half the amount today.

The incredible steel Killy with gold embossed indexes. A great buy at $262’000 in my opinion.

The superb 6200 fetched a new world record for the reference but only just slightly.

The Cartier with wonderful aged creme dial was extra-ordinary.

The Rolex 8171 Padelone with unique luminous hands was interesting.

Last, a personal favourite of mine. The Patek 3448 that sold towards the upper estimate.

It was a auction to remember. Thank you Phillips for the great event.