Investment returns Rolex: Gold Daytona Ref 6264

Fine WatchesCollector's InsightCollecting & Investing

Ever wondered what would have done better as an investment over the past 45 years? Buying a gold Rolex Daytona Ref 6264, a gold bar or buying shares in the most liquid and important equity index in the world, the S&P 500?

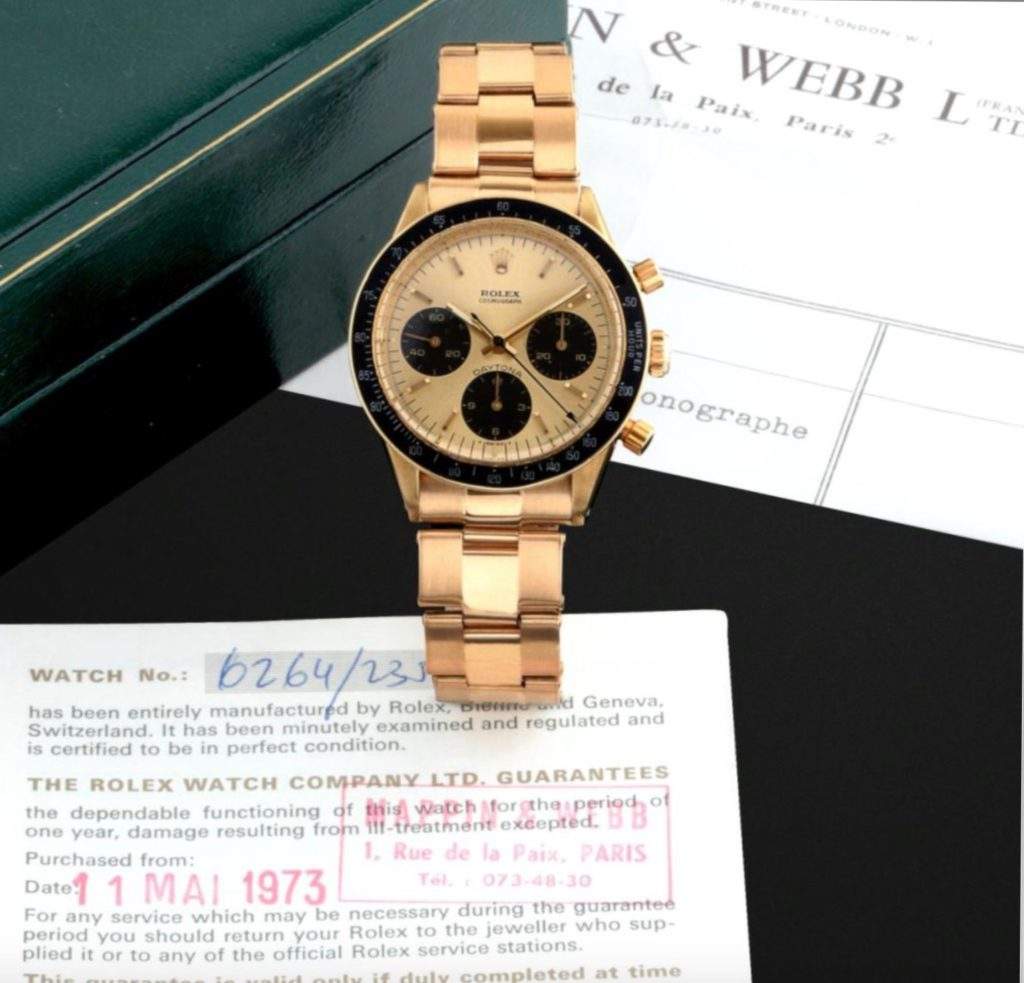

A recent sale that took place this summer of a gold Daytona made in 1973 and bought for the sum of 6020 French Francs also in 1973, in cash, had me wondering this very same question. Here is what I found out.

This summer I was in Monte Carlo, mostly for pleasure – but also to attend watch auctions of Artcurial and Boule.

There, a very fine and rare Rolex Gold Daytona Ref 6264 made in 1973 sold for €168’000 or roughly $193’000, using the exchange rate of 1.15 EUR/USD exchange rare on July 18th 2017. This very watch was bought new in May 1973 in Paris for 6020 French Francs at the time. The buyer paid cash.

This had me thinking the following question: What would have the buyer ‘s theoretical return been if he held on to this watch and sold it almost 45 years later?

Using the Federal reserve bank of St Louis data, the exchange rate of French Franc to the USD was 4.47 in May 1973, meaning it took 4.47 French Francs to buy one USD. That Gold Daytona 6264 costs the buyer $1’346 back in 1973. Assuming the buyer held on to the watch and sold it now in 2017, he would have had a return of 14’300% or 143x the original investment made in that very Gold Daytona watch. Not a bad return right?

However, in order to see if the return is good or not, we have to compare it to something.

After all there is always an opportunity cost of money. Maybe the owner could have instead sent one of his children to college for one year with the amount of the gold Daytona, or bought shares in a corporation or invested in a private company. What about if the owner had bought gold bars instead of the watch? How would he have fared? I wanted to compare the Daytona to other investable options to get a relative return.

Therefore, I took a look at what returns the S&P 500 would have delivered over more or less the same period. I also compared it to gold. Here is the chart below:

Having invested in the S&P500 in 1973 would have yielded a total return of 8297% or nearly 83x times your money. Had you invested let us say $1000 back in 1973 you would have nearly $83’000 today. Gold, on the other hand, would have been a relatively poor investment – yielding only a 13x fold return or 1326%.

It does not take a math genius to figure out that the Gold Daytona 6263 sold in 1973 would have been a much better investment compared with money in the most liquid and probably best performing stock market index of all time – the S&P 500. There are a few things to keep in mind, before you think of going out and buying 8-10 Gold Daytona and storing them in your safe as future retirement money:

- Cost of watch ownership: we don’t know what the costs of owning the watch would have been over the 45 year period. As most watch collectors know – it is important to service a watch to keep it running. Let us assume that the owner would had his watch serviced at least 5-6 times over that time frame. Surely those are costs that would have amounted to a tidy sum would need to be added to the overall costs of the watch owner to get a better picture of the return. This would have decreased the total return for the owner of the rare Gold Daytona.

- This Daytona is rare: We are using a very rare reference of 6264 Daytona – a rare model made only for two years. Also, this watch had service receipts as well as the original receipt. We cannot be sure that this return would apply to other gold Daytona, even if they are 4- digit serial number and manual wound models. This was an original and well kept watch. We cannot assume all gold Daytona will yield the same return.

And what about comparing it to say classic cars? How would have the Daytona returns fared here?

Let us assume that back in 1968 that a brand new Ferrari 275 GTB /4 costs $13’000 – which is more or less the price according to a very well-known source. Let us also assume today that a Ferrari 275 GTB/4 in mint condition with good history (as the Rolex Daytona model is in mint condition with owner’s papers) would be worth today $3.5m. If we do that math here, the return equates 27’000% (rounded up) or 270 times your initial investment. At first it seems to almost double the returns of our gold Daytona from 1973 (which carried a 14’300% return).

But with a car we have to factor in the running costs, insurance and maintenance and restoration costs too. Not to mention storage costs. Also the Ferrari was used as a 1968 base year so we have 5 more years factored into our calculation. So it is not an apples to apples comparison. After all those costs are deducted I am sure the Rolex Daytona and the Ferrari returns would be narrower (although the Ferrari will still come out ahead).

Closing thoughts

I have often stated this. I don’t believe in buying watches as an investment.

Collecting should be about fun, passion, hunting and always trying to improve in your knowledge. The end game of collecting is of course to always improve your collection according to your taste and information learned. If, within this game, you make some money on the side – consider it an added bonus. Collecting should not be about money first and foremost.

Watches have been a strong collecting category over the years in terms of financial appreciation. There have been some media reports that have highlighted art and classic cars, but not even included watches in their analysis. I have always thought that source should have included watches. Now of course not all watches show this kind of appreciation. But if you take one of the strongest brands in the world, Rolex, combine it with one of the most iconic models, the Daytona – along with original receipts, – this is of course going to be a strong contender for good returns.

This post is just an exercise of fun and playing around with numbers. In no way does it indicate anything, for one data point is indeed meaningless. But it shows that rare watches continue to attract a record amount of interest, especially those with receipts and in good original condition – today they are becoming rare trophy assets.

I only hope the new owner will not put it in the safe but instead wear and enjoy his Daytona.

(Main picture credit: Boule auctions).

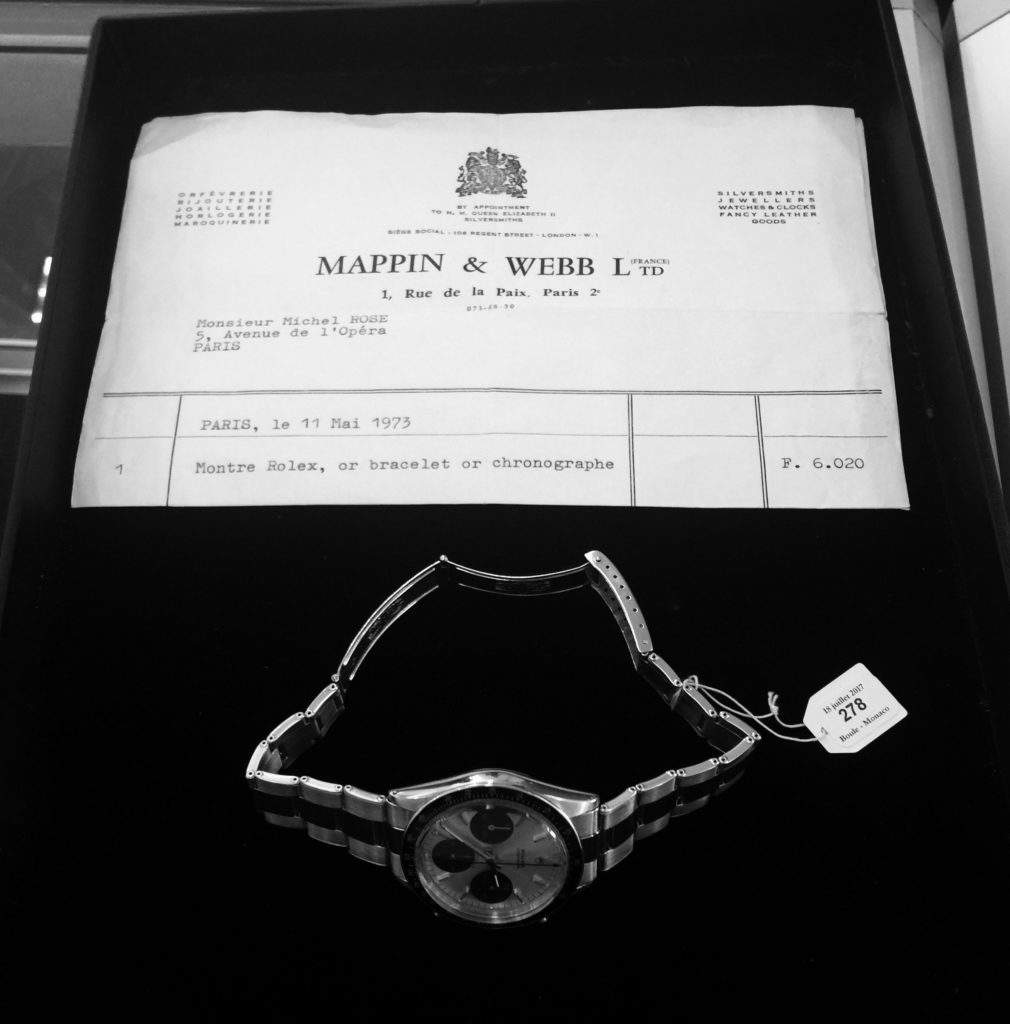

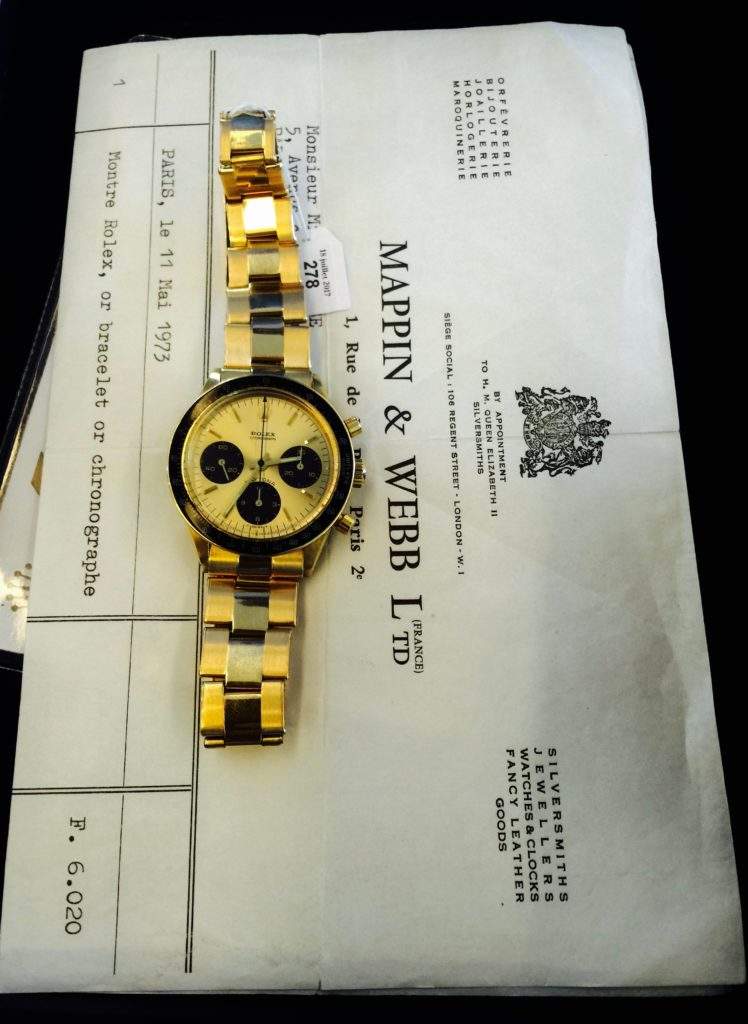

Here some pictures of the Rolex Daytona 6264, a rare reference that was only made for one to two years. Below the watch with the original receipt more clearly. Bought in May 1973 for FF 6020.

Below the watch as I found it lying with Boule Auction in Monte Carlo on the original receipt with purchase price clearly seen.

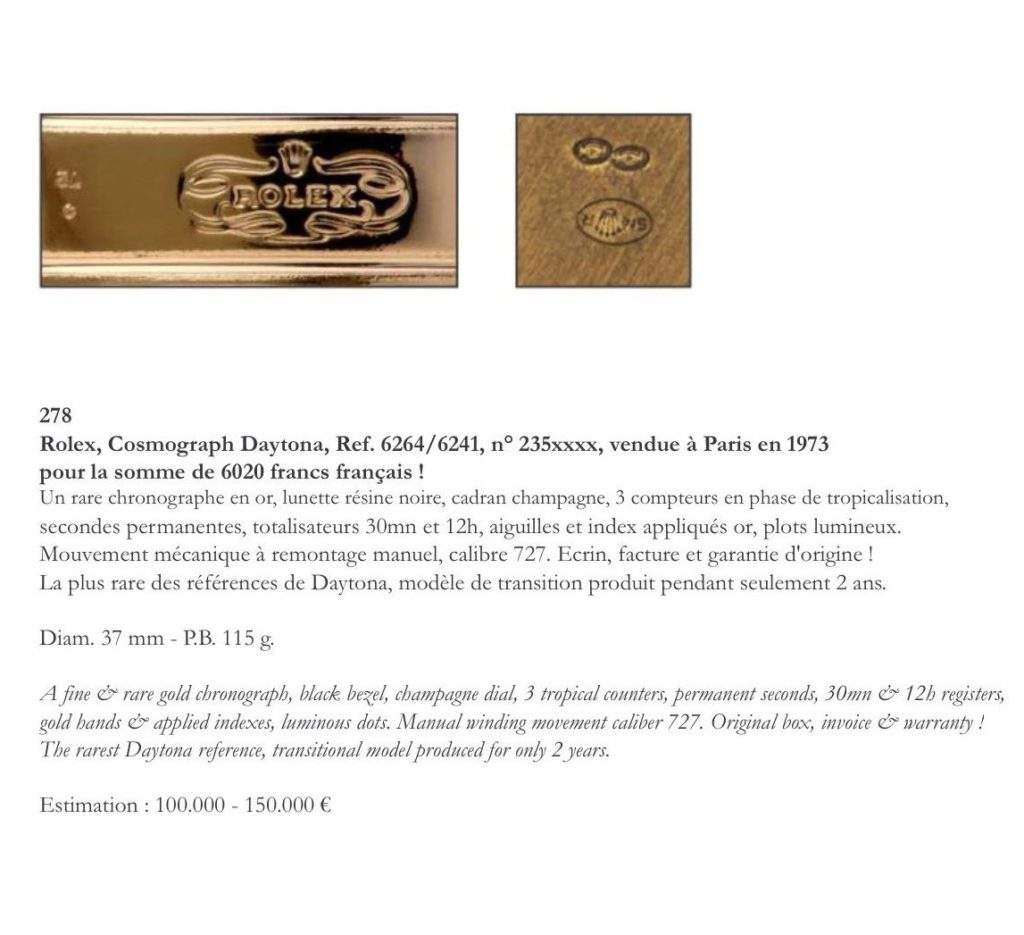

The watch as it was displayed in the Boule Auctions catalogue. The original guarantee can be seen below. (Credit Boule Auctions).

Below the gold stamps on the case and bracelet of the 6264. As it appeared with description in the Boule Catalogue. (Credit Boule Auctions).