Starbucks CEO: Vintage Rolex collector

Fine WatchesCollector's InsightCollecting & Investing

I will say this upfront: Howard Schultz is one of the best CEOs of America. He knows how to run a company.

I have followed him a long time, not only because he is CEO of Starbucks (of which I am a thankful shareholder) but also because I think he is a great leader, visionary and treats his employees fairly. His book Onward is a must read for people interested in business. While I sometimes write about investments – this post is not only about investments.

It is also about watches. More specifically vintage Rolex.

You see, Howard Schultz is an avid vintage Rolex collector.

I didn’t know this until I received my Forbes magazine of the 2016 billionaires a few days ago (sadly I did not make the cut again). Who is on the front cover? Howard Schultz with a Paul Newman vintage Rolex.

After doing research I found out that another well known Blog forum Jake at Jakes Rolex World already knew this back in 2013. Apparently Howard Schultz is well known among the Rolex community for collecting vintage Rolex.

He certainly can afford it. Howard Schultz has led Starbucks to incredible growth and made not only himself but more importantly also his shareholders very wealthy in the process. Which brings me to my next point and main topic of this post.

Would it not be interesting to find out what has performed better from a financial investment perspective? Vintage Rolex watches or Starbucks shares over the past 7-8 years?

I ask this question not only because its a fun (and admittedly a somewhat stupid exercise) – but also because many investors are flocking to buy vintage watches and other collectable even though they have no real collector interest. I think it is dangerous to do that.

Not only will these investors make mistakes but if they buy shares of solid companies that have strong brands – the performance is often superior than all other asset categories. Collectibles included.

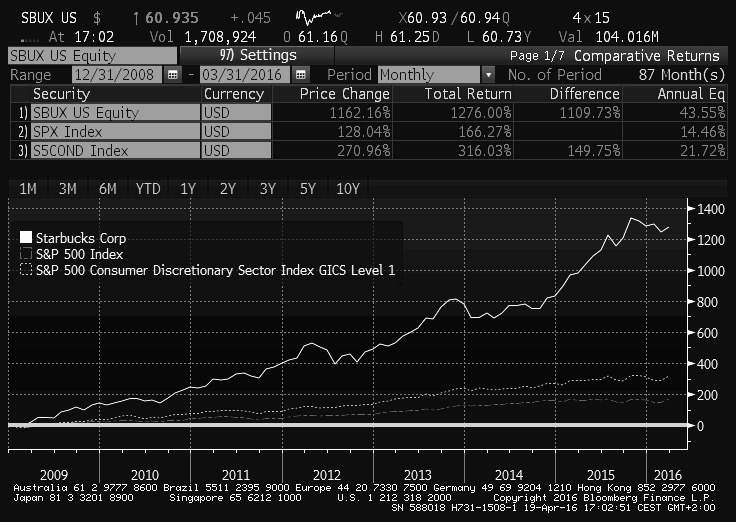

Lets look at what did better coming out of the financial crises. For both collectibles and the stock market- returns have increased substantially since then. As you can see from the chart below Starbucks was one of the great success stories since 2008.

They restructured and returned a whopping 1200%. For those not well versed in large numbers – this is 12x your money. See chart below.

Vintage Rolex?

Well using a 6538 in top condition sold at Christies in 2008 for example, is worth today at most CHF 300-350’ooo. That would yield a return of 400-450%. True a 6538 sold at Christies for CHF 520’ooo but that was a four liner and nicely aged dial. Even if we take this example as a benchmark the return would be 600%.

It is no different than with Paul Newman. Today a top PN with Panda dial (the most collectible in series made Paul Newman watch) is worth today CHF 270-320’ooo. In 2008 they were selling for an average of 50-60’ooo (see this example here). Sure a Panda 6263 sold once for CHF 420’000 but that was at the Daytona Auction One and does not represent the market price. Even if we take this outlier the return would still be a factor of 700%.

I think its fair to say that vintage Rolex even in top quality condition cannot match Starbucks return of 1200% from the 2008 financial crises lows. To be sure vintage Rolex has done exceptionally well and for sure the prices are 3-500% higher on average (my best guess/estimate).

In that respect they have easily beat the broader stock market average, the S&P 500, which returned a poorer 170%. From the lows of the financial crises in 2009 the stock market (S&P 500) broad return is a more acceptable 230-250% (depending on weekly or monthly data). But that still cannot match vintage Rolex prices.

So vintage Rolex collectors have done better than the stock market. Cool.

But Howard Schultz has done best of all.

Holding on to his Starbucks shares have made him a billionaire since the financial crises. Food for thought the next time any collector, auction house or dealer tells you that vintage Rolex is the best investment over time. Not necessarily true. Which is just fine for me.

Because vintage Rolex is best enjoyed on the wrist. And not stuck in a bank vault as an investment.

Disclaimer: As with any exercise comparing investment returns – the data changes quickly depending what timeframe you use. Please be aware I did not take loss or gain of currency into account (watches were measured partially in Swiss Francs but stock market is USD based). Also using Starbucks is an extreme example, the company faced severe problems in 2009 not only because of the crises – they expanded too fast and lost part of their DNA in the process. Starbucks restructured and is now stronger than ever. This is reflected in the share price today and even though I own a few shares – I would not buy any shares at current levels (rather I would even look to short them).

(Credit main picture: Jakes Rolex blog).