When you enter the world of watch collecting, one of the very first things you learn is the attractiveness of double signed dials.

Especially when it concerns Patek & Tiffany.

There are many attractive retailer names that played an important role in helping watch brands grow. I can think of Serpico Y Laino for Rolex and Patek in the 1940 and 1950s. Hausmann for Patek in the Italian market for the post war period. Beyer & Gübelin also played an important part in the German speaking world for Rolex and Patek. But there is one relationship that has been around forever and longer than most others.

That of Patek & Tiffany.

What is most interesting is that Tiffany is the only retailer in the world (that I am aware of) where Patek still allows the co-branding to take place. Except for some rare occasions (like the 250th anniversary for Beyer in 2010) Patek does not allow this co-branding anymore.

This shows how strong the bond is between the two brands still today.

The relationship started already back in 1876 when Tiffany represented Patek’s interest in the important American market. Today Tiffany signed Patek watches hold appeal for collectors based on this strong historic bond. So, with this post I wanted to do the following:

To take a look at one of the most sought-after models right now from Patek ‘The Nautilus’ and see what premium a Tiffany signed dials can bring. I will look at modern (5711/1A) and vintage (3800/1A).

We start with vintageRef 3800/1A:

Introduced in 1981 the 3800 is the most wearable vintage Nautilus in my opinion and is the first Nautilus to bear a central seconds. I wrote about it here as a PAK watch already. Let us compare Tiffany signed versus non-signed in the 3800 model.

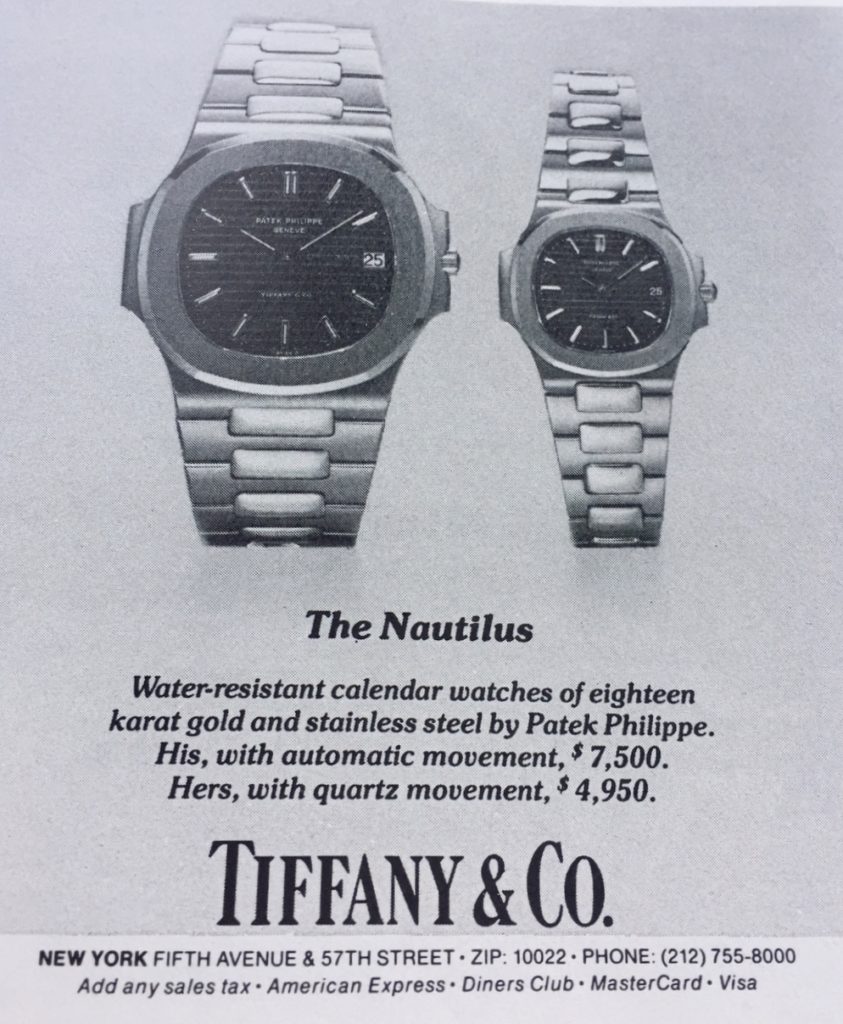

Although my data set is very small (I could only find 4x examples that were publicly traded) which are Tiffany signed not including bicolour or gold, my finding is quite interesting. In 2008 and in 2013 for some reason, the Tiffany signed dial versions carried no premium. In fact, it was the opposite. A full set 3800 non Tiffany signed, were more expensive than the Tiffany signed dials. A collector preferred a full set (box and papers etc) than the double signed Tiffany signature once in 2013 (Sotheby’s CHF16’200) (versus Tiffany signed in 2013) and 2008 (versus Tiffany signed in 2008 here).

When the set is the same (and assuming the condition is the same as well) we can say the following: A Tiffany signed dial is worth a 100% premium! That is the power of Tiffany signed Patek.

Below the 3800 with Tiffany signature from 1992.

(Credit: Rare & Fine).

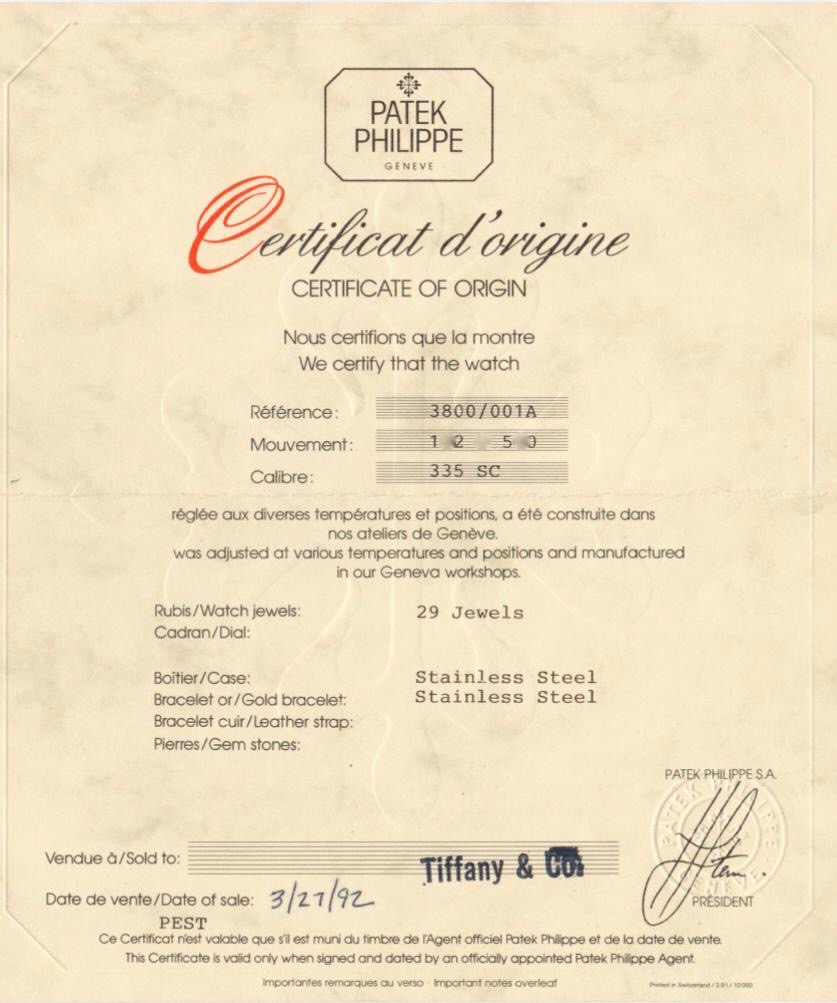

And the original papers Certificate of origin stating date of sale 1992 and sold naturally through Tiffany & Co.

(Credit: Rare & Fine).

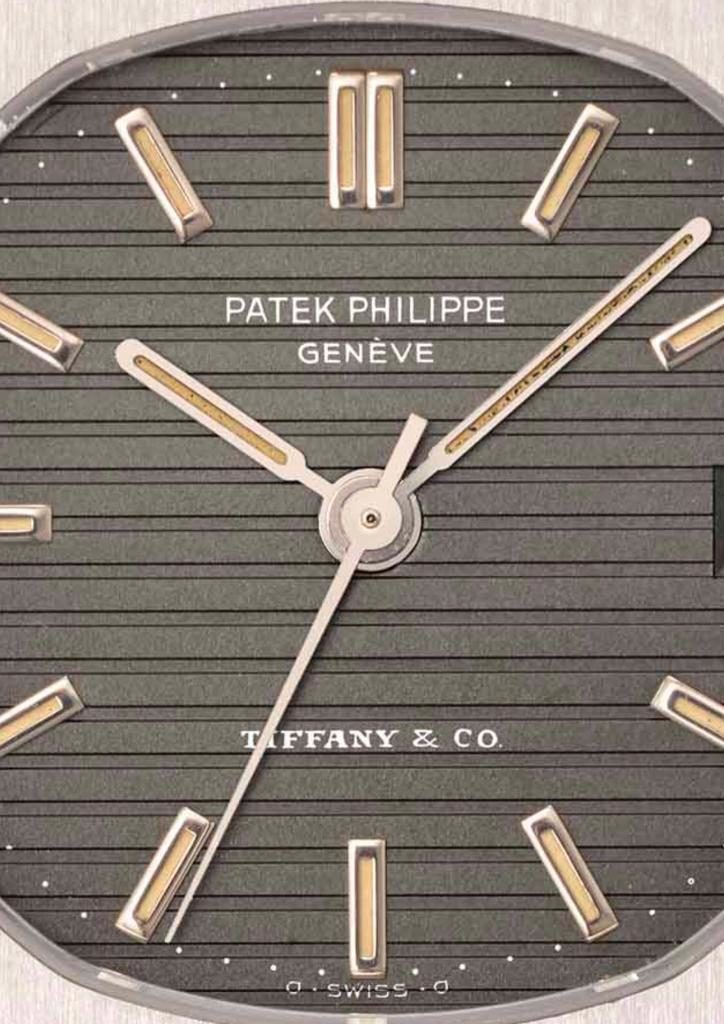

Below a closeup of a 3800 recognizable by the sigma indicators as well as the Tiffany & Co logo – which is more spaced out than later Tiffany logos that belong to the 5711.

(Credit: Christie’s).

5711/1A

Now let us look at the hottest watch on the market right now in the Patek world. The 5711.

If you want a brand new 5711 (black or white dial) well then you have to patient. There is a long waiting list, in fact the list is so long that most ADs have stopped putting names down for the list. Technically there is no waiting list anymore.

That doesn’t mean you have to wait for one in order to buy it. Like with many other in production Patek models, there are plenty of used or new unused grey market 5711/1A (the last time I checked at Chrono24 there where 183 pieces listed). It is here, in the so called grey market, where the euphoria lies for the 5711. Let me explain.

In 2016 you could have bought a 5711 at a premium for 50% of the list new price, or USD 12’000 over the official retail price of a Patek AD. As of today the premium has widened to 100% for a new and sealed watch. Even for a used watch you have to pay a premium of 60+% over the suggested retail price. I can’t think of any ‘in almost thirteen years production watch’ – not even the strongly requested Rolex sport model watches like Daytona or GMT – that generate such a premium.

Tiffany signed 5711

How does it look for a Tiffany signed 5711? This is where the real euphoria starts.

Remember that the official retail of a Tiffany signed 5711/1A was the exact same price as a normal 5711. Are you ready? So, in 2016, the premium for a Tiffany signed black dial watch was 220% of the average retail price of a normal watch. By 2018 this had widened to almost 500%.

One of the last ones sold at Phillips in November 2018 in Geneva, with the most enthusiastic bidding I have ever seen. Multiple phones and room bids fought for this watch and it ended up selling for CHF 125’000 including premium (but excluding taxes). The suggested retail price of the watch is CHF 26’280. About three weeks later a similar watch (but from 2016 where the suggested retail was roughly CHF 4’500 less) fetched exactly the same price at Sotheby’s in New York.

Again, we are only using two watches which have publicly traded at auction in 2018, but the trend is clear. A Tiffany signed 5711 (see below) is getting more expensive to own as time goes by (assuming you cannot buy a new one).

(Credit: Rare & Fine).

Understanding supply better of 5711

My data set is much too narrow to do a serious statistical analysis; this post in merely about pointing out the basic trend of Tiffany signed Nautilus watches, be it vintage or production models. The fact that I could only find four data points for each series shows how rare these watches are.

There are no public data of how many Ref. 5711/1A Patek ships every year. But to get an understanding how rare and limited these watches are, my friend (who prefers to remain anonymous) thought to approach it this way:

Assuming there are roughly 430 retail AD’s for Patek worldwide (the published number is 436 plus the Salon), and each retail point gets an average of 1 – 3 pieces with a black dial and 1 – 3 pieces with a white dial a year. That would lead to a calculated production number rage of roughly 10’000 – 30’000 total pieces over the so far 13 years of production of the 5711/1A. That is a lot of 5711 and in no way can we consider this watch to be rare.

What that large number shows however, is that the demand for this watch must be huge and people are ready to pay a large premium to own one. Also, the typical Patek collector keep’s their watch as the advertising says ‘for the next generation’; only about 1% of the estimated production is publicly offered in the secondary market.

Looking at Tiffany signed 5711

But let us narrow it down for only Tiffany signed dials. Let us assume each of the six Tiffany Patek stores gets 1 – 2 pieces of each dial color (so black and white) a year.

That equates to 6 – 12 pieces of the 5711/1A being sold bearing a Tiffany logo per year (for simplicity we assume an even spread of white and black dial). Let us further assume that the 5711/1A will eventually get replaced by 2030. That means a total of 144 to 288 pieces over a 25 year period that Tiffany signed 5711.

Over a 25 year period Patek will likely not make more than 200 Tiffany signed 5711 watches. That is not a lot.

Comparing Tiffany 5711 to other important Patek

While I know many references of watches that have had less production (think 1831 by Rolex, or 3428 by Patek) the Tiffany 5711/1A will remain a very rare watch.

The legendary Ref 2499 was made only 349x. The 1518, the first perpetual chronograph from Patek, was made 281x. In other words (and assuming supply will remain constant) Tiffany signed Nautilus is highly likely to be made in less examples or roughly the same than the two most legendary references from Patek Philippe.

Besides the obviously huge demand, the rarity factor is something to keep in mind before you think the premiums are irrational.

Closing thoughts

Right now, there is hype for all things Nautilus. All models are sold out and there are long waiting lists for practically any Nautilus.

When it comes to the classic steel, time only models, it gets even worse. Especially with the current model 5711. And once you put a Tiffany signature on the dial – then there is euphoria. Think about it: A steel time only watch just with a Tiffany signature commands a 500% or more premium over one that you could buy at the store – without signature – if you get access to one.

If you want to own a Nautilus I would personally go an entirely different route. Since I am into vintage watches and I have a small wrist I would buy a 3800 Nautilus with Tiffany signed dial.

The best part is that it won’t cost you a fortune. The last one sold for CHF 51’000 in 2017. So, you basically are getting a Tiffany signed Nautilus for the same price as a normal 5711 on the grey market today. Does this make sense? Not in my view. Even if the 3800 is substantially a smaller watch (37mm) versus 42.5mm for the 5711 modern Nautilus.

Sometimes having a small wrist is not so bad.

NB: I would like to sincerely thank an anonymous Patek collector and expert for supporting me to write this article and providing insight used in this post. Also for his unique insight into the dynamics of Nautilus both old and new. Below some great pictures.

We start with a rare so called Type 1 hash marked dial, the most rare configuration 3700/1A from 1976/77. Only two handful of these are known.

Khanjar 3700 anyone?

Let us compare it to the more modern 5711 below. Again with Tiffany & Co dial.

The difference between an early 5711 (picture on top) and new generation 5711 which has a slightly different dial layout where the Patek signature is based.

A old Patek advertisement presumably from a German magazine.